Where to go next

Most people compare personal loans by interest rate or monthly payment. That’s how fees sneak in and quietly raise your real cost. Fees decide whether a “good APR” is actually good—and whether refinancing or early payoff will save you money later.

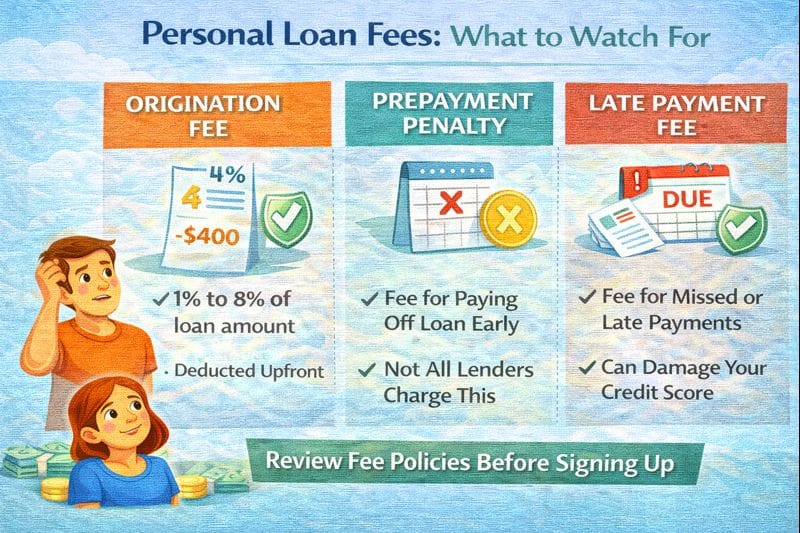

This guide breaks down the main personal loan fees (origination fee, prepayment penalty, late fees), how they work, and how to spot fee traps before you sign.

Quick answer / Key takeaways

- The three fees to check first: origination fee, late payment fee, and prepayment penalty.

- Origination fees can reduce your payout (“funded minus fee”) and raise real cost.

- Prepayment penalties can kill the benefit of paying off early or refinancing.

- Late fees and penalty APR rules vary, but one missed payment can get expensive fast.

- Always compare offers using a fee checklist, not just APR: how to compare loan offers.

Personal loan fees (the big three)

1) Origination fee (personal loan)

Origination fee is an upfront fee some lenders charge to issue the loan. It can be:

- deducted from the funds you receive, or

- added into the loan structure depending on the lender.

If you’re consolidating debt, this matters a lot because you may need a specific cash amount to pay off balances.

Deep dive: origination fee explained.

2) Prepayment penalty (personal loan)

A prepayment penalty is a fee charged if you pay the loan off early (or sometimes if you make large early payments). Not all lenders have this, but if it exists, it changes your strategy.

If your plan is “I’ll refinance later” or “I’ll pay it off early,” you must confirm this fee before you sign.

Early payoff guide: early payoff refinance.

3) Late fee (personal loan)

Late fees apply if you miss the payment deadline or grace period. A late payment can also:

- be reported to credit bureaus, and

- trigger additional consequences depending on the lender’s terms.

If you’re trying to protect your credit, payment history still matters more than almost anything.

Credit basics (why on-time matters): what is a credit score.

Other fees you may see (read the terms)

Not every lender charges these, but they show up often enough to check:

- returned payment / NSF fee

- paper statement fee

- payment processing fees for certain methods

- loan modification or “extension” fees

- optional products bundled into the loan (the cost can be real even if the pitch is “helpful”)

If an offer feels “too easy,” double-check you’re not being pushed into predatory terms.

No credit check loans scams.

Table: Fees (what they mean and why they matter)

| Fee type | What it is | Why it matters | Your best move |

|---|---|---|---|

| Origination fee | Upfront fee to start the loan | Raises cost and can reduce payout | Compare net funding + total cost |

| Prepayment penalty | Fee for paying early | Can block early payoff/refi savings | Avoid if you plan to pay early |

| Late fee | Fee for missing a payment | Adds cost + can hurt credit | Autopay + buffer |

| NSF/returned payment | Fee if payment fails | Adds cost and can cascade | Use a stable payment account |

| Add-on products | Optional “extras” | Inflates cost | Decline anything non-essential |

Origination fee personal loan (how it hits you in real life)

Origination fees matter in two ways.

1) “Loan funded minus fee” problem

You apply for $10,000. If a fee is deducted, you might receive less than $10,000 in your bank account. If you needed the full $10,000 to pay off cards, you’re short.

2) APR can look worse (or confusing)

APR may rise relative to interest rate because the fee is part of the finance cost.

APR guide: personal loan apr explained.

Origination deep dive: origination fee explained.

Prepayment penalty personal loan (how it can trap you)

People think: “If I pay early, I save interest.” Usually true—unless the loan penalizes you.

If a prepayment penalty exists, ask:

- does it apply to full payoff only or extra principal payments too?

- is it time-based (only in first X months)?

- what is the fee amount/formula?

If you’re planning early payoff or refinance, you need clean terms:

early payoff refinance.

Late fee personal loan (how to prevent it)

Late fees are avoidable if you build simple defenses.

Step 1: Autopay at least the minimum

This is the “don’t get wrecked” move.

Step 2: Build a payment buffer

Keep at least one payment amount in the account you use for autopay.

Step 3: Know your due date and grace period

Don’t assume “a few days doesn’t matter.”

Step 4: If you’re struggling, contact the lender before you’re late

Some lenders will offer temporary options, but it’s harder after missed payments hit.

Loan fee checklist (use this before you sign)

This is the checklist you should run on every offer.

Must-know questions

- Is there an origination fee? If yes, how much and is it deducted from funding?

- What is the APR and interest rate?

- Is there any prepayment penalty? If yes, what triggers it and when does it apply?

- What is the late fee and when is a payment considered late?

- Are there any monthly/admin fees?

- Are there add-on products included by default?

- What is the total amount repaid over the full term?

Offer comparison guide: how to compare loan offers.

Common mistakes

- Ignoring origination fees because “APR looks fine.”

- Taking a loan with prepayment penalties while planning early payoff/refi.

- Choosing the lowest monthly payment (longest term) and paying far more total interest.

Loan term length. - Agreeing to add-ons you don’t need.

- Signing without confirming net funding amount.

Examples / scenarios

Scenario 1: “I’m consolidating cards and need exactly $12,000.”

Origination fee can reduce what you receive. Confirm net funding before you accept the loan.

Origination fee explained.

Scenario 2: “I plan to pay off early.”

Make sure there is no prepayment penalty and confirm how extra principal payments work.

Early payoff refinance.

Scenario 3: “I missed one payment and got hit with fees.”

Lock in autopay, build a buffer, and avoid stacking new obligations you can’t sustain.

FAQ

What fees do personal loans typically have?

Common fees include origination fees, late fees, and sometimes prepayment penalties. Some lenders also charge NSF/returned payment fees or optional add-on costs.

What is an origination fee on a personal loan?

An upfront fee some lenders charge to issue the loan. It can be deducted from the funds you receive or reflected in APR.

Origination fee explained.

Do personal loans have prepayment penalties?

Some do, many don’t. If you plan to pay early or refinance, confirm the terms before signing.

Early payoff refinance.

Can a late payment on a personal loan hurt credit?

Yes. Beyond late fees, late payments can be reported and damage credit history.

How do I compare loan fees between lenders?

Use a checklist: origination fee, net funding, APR vs rate, late fee rules, and any prepayment penalty—then compare total cost.

How to compare loan offers.