Where to go next

APR is the number lenders and ads love to wave around—because most people don’t know what it actually means. And if you compare loans wrong, you can “win” a lower monthly payment and still lose thousands in extra cost.

This guide explains what APR is on a personal loan, how APR differs from interest rate, what APR usually includes, and how to compare APR the right way.

Quick answer / Key takeaways

- APR is the annual cost of borrowing, and it may include certain fees (not just interest).

- Interest rate is the rate used to calculate interest on your balance; it may be lower than APR.

- Two loans can have the same monthly payment but very different total cost depending on APR and term.

- Compare offers by APR + fees + total interest, not by payment alone.

- Origination fees can make APR higher and reduce the cash you actually receive.

Origination fee explained.

What is APR on a loan?

APR (Annual Percentage Rate) is a standardized way to express the cost of borrowing per year. The goal is to help borrowers compare offers more fairly—especially when fees exist.

Why APR exists

Interest rate alone can hide cost when lenders charge fees. APR tries to make those costs visible in one number.

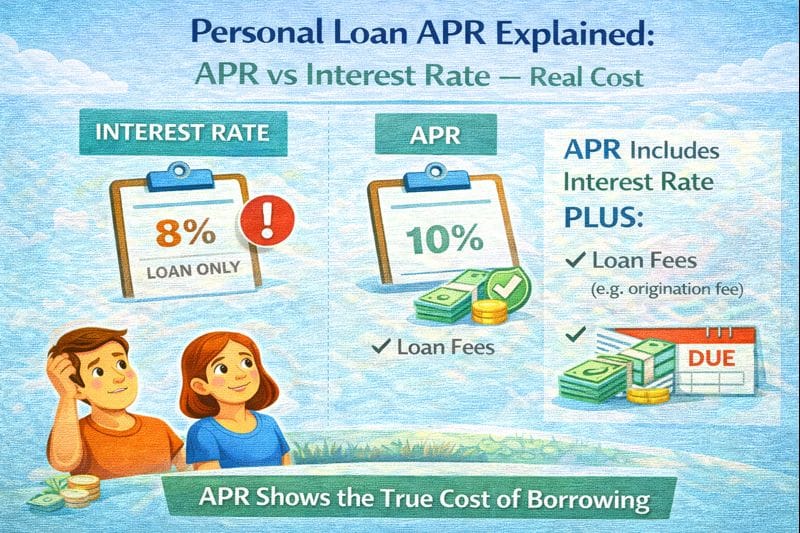

APR vs interest rate on a personal loan (what’s the difference?)

This answers your tail: “APR vs interest rate personal loan.”

Interest rate

- Used to calculate the interest portion of your payments.

- Think of it as the “raw price” of borrowing before fees.

APR

- Attempts to reflect the yearly cost including certain upfront costs (like origination fees).

- Often higher than the interest rate when fees are present.

Practical takeaway: If two lenders advertise the same interest rate but one has an origination fee, the APR will usually be higher on the fee loan.

What does APR include (and what it might not)

APR commonly reflects:

- interest cost, and

- certain upfront finance charges (often origination fees).

APR may not fully reflect:

- late fees,

- optional add-ons,

- penalties triggered by missed payments,

- your real cost if you refinance or pay off early.

That’s why you still need a fees checklist:

personal loan fees.

Origination fee and APR (how it changes the real cost)

An origination fee can hit you two ways:

- increases your effective cost (APR), and

- can reduce the amount you receive (loan funded minus fee).

Deep dive: origination fee explained.

How to compare APR (the right way)

This answers your tail: “how to compare APR.”

APR is a strong comparison tool only if:

- the loan terms are comparable, and

- you also consider term length and total cost.

Step 1: Compare apples to apples (same term length)

A 3-year loan and a 5-year loan can have different APRs and very different total interest.

Term guide: loan term length.

Step 2: Look at total cost, not just APR

APR is a shortcut. The real scoreboard is:

- total interest paid over the term,

- total fees,

- total dollars repaid.

Offer comparison checklist: how to compare loan offers.

Step 3: Check what fees are included

If one loan has “no origination fee” and another does, APR comparisons become meaningful fast.

Step 4: Check the net funding

If a fee is taken out of the disbursement, ask:

- “How much will I actually receive in my bank account?”

Table: APR vs interest rate (what each tells you)

| Metric | What it tells you | Best use | What it can hide |

|---|---|---|---|

| Interest rate | Cost of borrowing before fees | Understanding payment interest portion | Fees can make the deal worse |

| APR | Annual cost including certain fees | Comparing offers, especially with fees | Doesn’t capture late fees or behavior risk |

| Monthly payment | Cash flow per month | Budget fit check | Can hide long-term cost |

| Total cost | Total dollars repaid | Final decision metric | Requires looking at full terms |

“Real cost” examples (why APR matters)

Example 1: Same rate, fee vs no-fee

- Loan A: low interest rate + origination fee

- Loan B: slightly higher interest rate + no fee

Even if Loan A looks cheaper on rate, the fee can flip the deal. That’s why APR exists: it tries to expose that.

Example 2: Lower payment, higher total cost

A longer term can lower the monthly payment while increasing total interest. You can feel relief monthly and still pay more overall.

Term math: loan term length.

Step-by-step: how to evaluate a personal loan offer

- Write down the term length and loan amount.

- Note the interest rate and APR.

- List all fees (origination, late fees, prepayment penalties).

Personal loan fees. - Calculate the total dollars repaid (principal + total interest + fees).

- Compare two offers side-by-side using the same checklist.

How to compare loan offers.

Common mistakes

- Comparing only interest rate and ignoring fees.

- Comparing only monthly payment and ignoring term length.

- Forgetting net funding when origination fees are deducted.

- Taking a longer term just to make approval/payment easier.

- Falling for “no credit check” ads where cost is hidden elsewhere.

No credit check loans scams.

Examples / scenarios

Scenario 1: “Offer A has lower APR, but higher payment.”

If the term is shorter, higher payment can be normal. Compare total cost and what you can afford sustainably.

Loan term length.

Scenario 2: “Offer B has a great rate but an origination fee.”

Look at net funding and total dollars repaid. Sometimes a no-fee loan with a slightly higher rate is cheaper overall.

Origination fee explained.

Scenario 3: “I just want the lowest payment.”

Lowest payment often means longest term. Make sure the total interest doesn’t cook you.

Loan term length.

FAQ

What is APR on a personal loan?

APR is the annual cost of borrowing expressed as a percentage and may include certain fees in addition to interest.

Is APR the same as interest rate?

No. Interest rate is the base rate used to calculate interest. APR is usually higher when fees are included.

What does APR include?

APR commonly reflects interest plus certain upfront fees like origination fees. It usually doesn’t reflect late fees or optional add-ons.

How do I compare APR across lenders?

Compare loans with similar terms, then use APR alongside total cost (total interest + fees) to choose the best deal.

How to compare loan offers.

Why is my APR higher than my interest rate?

Fees (especially origination fees) can raise the APR above the interest rate.

Origination fee explained.