Where to go next

Origination fees are the most common “silent cost” in personal loans. People see a loan amount and think that’s what they’ll receive. Then the money hits the bank account short—because the lender took the origination fee out first.

This guide explains what an origination fee is, how origination fees work, what “loan funded minus fee” means, and how to decide between a fee loan and a no-fee loan.

Quick answer / Key takeaways

- An origination fee is an upfront fee some lenders charge to issue a personal loan.

- The fee often comes out of the funding amount, so you may receive less cash than the loan amount.

- Origination fees can raise the true cost (APR) even if the interest rate looks competitive.

- The right comparison is total dollars repaid and net cash received, not just the rate.

- If you need a specific cash amount (like consolidation payoff), net funding matters more than vibes.

What is an origination fee?

An origination fee is a charge for processing/underwriting/funding a loan. Lenders may describe it as an administrative fee or setup fee. It’s typically expressed as a percentage of the loan amount or a flat fee.

If you’re still learning the basics of personal loans:

How personal loans work.

How origination fees work (the funded-minus-fee reality)

This answers your tail: “how origination fees work.”

The common setup

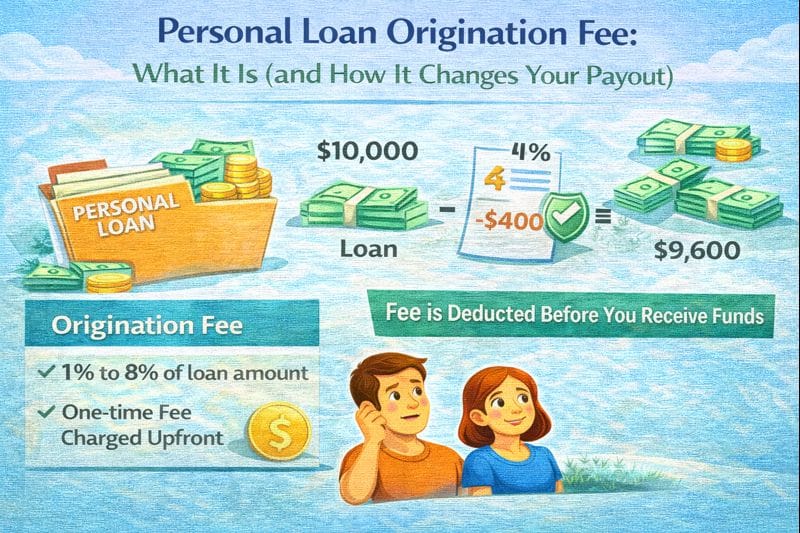

You accept a loan for $10,000 with an origination fee. If the lender deducts the fee at funding:

- you borrow $10,000 (that’s what you repay),

- but you receive less than $10,000 in your account.

What “loan funded minus fee” means

This answers your tail: “loan funded minus fee.”

It means the lender funds your loan and immediately subtracts the origination fee from the disbursement.

Practical consequence: you’re paying interest on the full loan amount even though you didn’t receive the full amount in cash.

Simple example (so you don’t get fooled)

- Loan amount: $10,000

- Origination fee: $500

- Cash you receive: $9,500

- Amount you repay interest on: $10,000

That $500 is not just “a small fee.” It changes your real cost.

APR explains why this shows up in the APR number:

personal loan apr explained.

Table: Origination fee impacts (what changes)

| Item | No origination fee | With origination fee (deducted) |

|---|---|---|

| Cash received | Usually equals loan amount | Less than loan amount |

| Amount you repay | Loan amount | Full loan amount (even though you got less) |

| APR vs interest rate | Often closer together | APR usually higher than rate |

| Consolidation payoff fit | Easier to match payoff amount | Can come up short if you need exact cash |

| Best for | Borrowers who want clean pricing | Borrowers who still win on total cost |

When an origination fee can be worth it

Origination fee isn’t automatically bad. It can be worth it if:

- the APR/total cost is still lower than alternatives,

- the payment fits your budget,

- you understand the net funding and it still meets your goal.

This is common when the “fee loan” has a materially lower interest rate than a no-fee loan.

When an origination fee is a problem

Origination fee is a problem if:

- you need a specific cash amount and the net funding comes up short,

- you’re consolidating and thought you’d pay off everything but you’re short by the fee,

- the lender sells you on “low rate” while the fee makes the deal worse.

Debt consolidation loan guide.

How to compare a fee loan vs no-fee loan (the right method)

Step 1: Compare net cash received

Ask: “If I accept this offer, how much hits my bank account?”

Step 2: Compare total dollars repaid

Compare principal + interest + any fees over the full term.

Step 3: Compare payoff timeline and term

A longer term can hide cost.

Loan term length.

Step 4: Run a consolidation-specific check (if applicable)

If you’re paying off cards:

- does net funding fully cover balances?

- will you still owe a leftover balance on cards after the payoff?

Balance transfer comparison: balance transfer vs personal loan.

“How to” check origination fee in an offer (checklist)

Before you accept:

- Is there an origination fee? If yes, how much (percent/flat)?

- Is the fee deducted from funding or added elsewhere?

- What is the net disbursed amount (cash you receive)?

- What is APR and interest rate?

- What is the total repayment amount over the term?

- Is there any prepayment penalty if you pay early?

Early payoff refinance.

Full fees guide.

Offer comparison checklist.

Common mistakes

- Assuming the loan amount equals the cash you receive.

- Comparing only interest rate (not APR and net funding).

- Taking a longer term to “make payment work” and then paying much more total interest.

Loan term length. - Consolidating debt but leaving balances open and then re-borrowing.

Examples / scenarios

Scenario 1: “I need $15,000 to pay off cards.”

Confirm net funding. If the fee reduces payout, you may need a larger loan amount—or a no-fee offer.

Scenario 2: “Fee loan has lower APR than no-fee loan.”

If APR is truly lower and net funding still meets your goal, fee loan can be the better deal.

Scenario 3: “I’m planning to refinance or pay off early.”

Confirm there’s no prepayment penalty that cancels your strategy.

Early payoff refinance.

FAQ

What is an origination fee on a personal loan?

An upfront fee some lenders charge to issue the loan. It may be deducted from the funds you receive or reflected in APR.

How do origination fees work?

Often the fee is taken out at funding, meaning you receive less cash than the loan amount but repay interest on the full amount.

What does “loan funded minus fee” mean?

It means your loan was disbursed and the origination fee was subtracted from your payout.

Is a loan with an origination fee bad?

Not always. It can still be a good deal if the APR/total cost is competitive and net funding meets your goal.

How can I avoid origination fees?

Look for lenders/offers that advertise no origination fee and compare total cost side-by-side.

How to compare loan offers.