Where to go next

When people search “no credit check personal loans,” they usually mean one of two things:

- “I need money and I don’t want my credit pulled,” or

- “I keep getting denied and I need a lender who will say yes.”

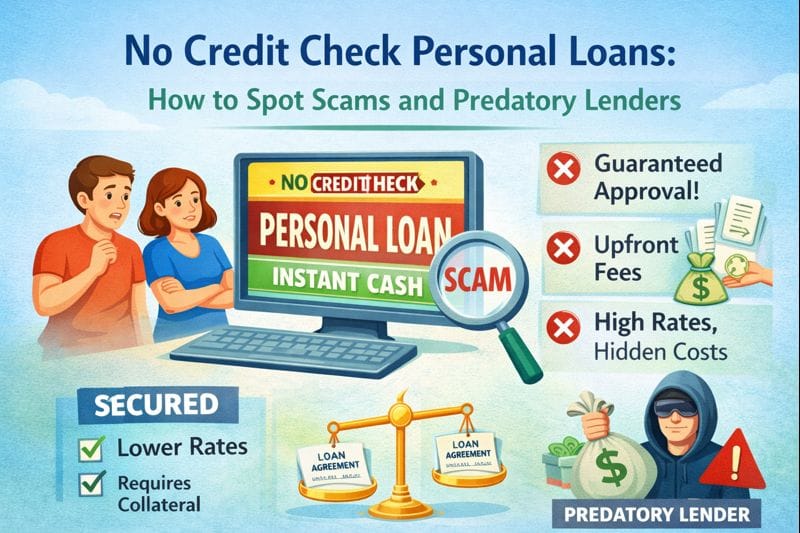

Predatory lenders and scammers love that desperation. They use the words “no credit check,” “guaranteed approval,” and “instant funding” to pull you into expensive or fake offers.

This guide shows the real meaning behind “no credit check,” the most common scam patterns (including upfront fee scams), and a step-by-step way to verify any lender before you hand over money or sensitive info.

Quick answer / Key takeaways

- “No credit check” is often marketing. Many lenders still verify risk via income/bank data, or they price the loan extremely high.

- “Guaranteed approval” is a major red flag—real lenders underwrite and can say no.

- Upfront fees before funding are one of the clearest scam signals.

- The safest way to shop is prequalification (soft pull), then applying to 1–2 best offers.

Prequalify soft pull - If you have bad credit, focus on realistic options and affordability first.

Bad credit personal loans

What “no credit check” really means

A legitimate lender can’t lend responsibly without checking risk. If they truly don’t check credit at all, they usually replace it with something else:

- heavy income verification

- bank-account cash flow tracking

- collateral requirements

- extremely high pricing and fees

So the real question isn’t “do they check credit.” The real question is:

Is this deal safe, verifiable, and affordable?

Guaranteed approval loan scams (how they work)

This answers your tail: “guaranteed approval loan scams.”

A “guaranteed approval” pitch is designed to bypass your judgment. Common patterns:

- They promise approval before asking basic questions.

- They push urgency: “only today,” “last slot,” “funding window closes.”

- They avoid showing full terms until you’ve paid or shared sensitive data.

- They steer you into unusual payment methods or instant-transfer apps.

Reality: A real lender can’t guarantee approval before underwriting. If someone guarantees, they’re selling a trap.

Upfront fee loan scam (the classic)

This answers your tail: “upfront fee loan scam.”

How it usually looks

- You “get approved.”

- Then they say you must pay a fee before funding:

- “insurance fee,” “processing fee,” “verification fee,” “tax,” “membership,” “deposit,” “first payment.”

- After you pay, they disappear or keep asking for more fees.

Rule: If money must leave you before money reaches you, treat it as a scam until proven otherwise.

How to spot predatory lenders (the practical checklist)

Predatory doesn’t always mean “fake.” Some lenders are real—just structured to keep you paying forever.

Predatory loan warning signs

- APR and fees are unclear or change mid-process

- They focus only on monthly payment, not total cost

- Very long terms used to “make it affordable”

- Large fees deducted from funding (“funded minus fees”) without explaining it

- Prepayment penalty that traps you in the loan

Table: “No credit check” offer — legit vs scam vs predatory

| Signal | More legit pattern | Scam / predatory pattern |

|---|---|---|

| Approval language | “You may qualify” / “subject to verification” | “Guaranteed approval” |

| Fees before funding | No payment required to “release funds” | Upfront fee demanded first |

| Terms disclosure | Full APR/fees/term shown early | Vague terms, “we’ll explain later” |

| Verification | Standard income/identity checks | Asks for risky info fast or avoids underwriting |

| Payment method | Normal, traceable methods | Gift cards, crypto, weird transfers, urgency |

| Pressure tactics | You can review and decide | “Sign today” fear scripts |

Step-by-step: how to verify a lender before you apply

Step 1: Use prequalification first (soft pull shopping)

If you’re trying to avoid hard inquiries, prequalify instead of applying everywhere.

Prequalify soft pull

Step 2: Demand the terms upfront (before you share sensitive info)

You should be able to see:

- APR

- total fees (origination, late fees, prepayment penalty if any)

- term length

- total cost / total repaid

Compare correctly: How to compare loan offers

Term tradeoffs: Loan term length

Step 3: Confirm net funding (what actually hits your account)

Ask: “If there’s an origination fee, how much do I receive?”

Origination fee explained

Step 4: Watch how they communicate

Red flags:

- pressure to pay or sign immediately

- refusal to put terms in writing

- dodging questions about fees or payoff

Step 5: Protect your identity and banking info

Don’t share:

- login credentials to your bank

- one-time passcodes

- “verification” payments to random accounts

- payment via gift cards/crypto/strange apps

A legit loan process may ask for sensitive information—but it shouldn’t ask for it in a rushed, chaotic way or coupled with an upfront fee demand.

Safer alternatives to “no credit check” loans

If your credit isn’t strong, the move is usually not “find someone who won’t check.” It’s “find a deal you can survive.”

Option 1: Prequalify and compare realistic offers

Prequalify soft pull

How to compare loan offers

Option 2: Improve approval odds first (if timing allows)

- reduce utilization

- stabilize income documentation

- avoid new inquiries for a short stretch

Credit fast wins: credit utilization

Option 3: Consider structured bad credit options carefully

Option 4: If consolidating credit cards, compare the two clean paths

Common mistakes

- Paying an upfront fee because you’re stressed and want it to be real.

- Believing “guaranteed approval” is a benefit (it’s a warning).

- Comparing only monthly payment (predatory loans love this).

- Taking a long-term high-cost loan that blocks your budget every month.

Examples / scenarios (If X → do Y)

Scenario 1: “They approved me instantly and now want a fee.”

Walk away. A real lender doesn’t require an upfront payment to release funds. Don’t “test it with a small fee.” That’s how the scam starts.

Scenario 2: “I need a loan but I don’t want hard inquiries.”

Prequalify first, shortlist offers, then apply to 1–2 best options.

Scenario 3: “I have bad credit and I’m desperate.”

Slow down. Desperation is the scam trigger. Use realistic options and affordability rules, not “no credit check” marketing.

Bad credit personal loans

FAQ

Are no credit check personal loans real?

Some offers exist, but “no credit check” often means they use alternative data or they price the loan very high. The bigger issue is whether the deal is verifiable and affordable.

Is “guaranteed approval” always a scam?

Treat it as a major red flag. Real lenders underwrite and can deny applications.

What is an upfront fee loan scam?

It’s when a “lender” demands money before sending you loan funds (processing/insurance/verification fees). After payment, they disappear or ask for more.

How can I get a loan without hurting my credit?

Use prequalification (soft pull) first, then apply only to the best offers.

Prequalify soft pull

What should I compare before taking any loan?

APR, fees, term length, net funding, and total cost.

How to compare loan offers

What’s a safer option if I have bad credit?

Focus on realistic bad credit options and avoid predatory terms.

Bad credit personal loans