Where to go next

- Personal Loans hub

- How to compare offers

- APR explained (real cost)

Term length is where lenders “make the payment look good.” A longer term can drop your monthly payment—then quietly add years of interest. A shorter term can save a lot in total cost—if the payment doesn’t squeeze you into late payments.

This guide shows how personal loan term length changes total interest, how to choose between a 3-year vs 5-year loan, and the simple rule to pick a term that doesn’t break your budget.

Quick answer / Key takeaways

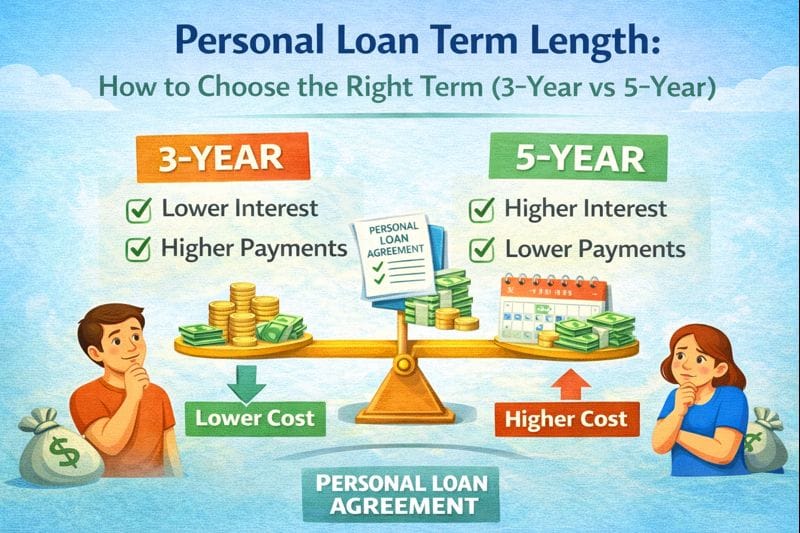

- Longer term = lower payment, higher total interest (usually).

- Shorter term = higher payment, lower total interest (usually).

- The best term is the shortest one you can pay comfortably (with buffer).

- If a higher payment risks late payments, the “cheaper” term becomes expensive fast.

- Always compare offers by total cost, not payment alone: how to compare loan offers.

What does “loan term length” mean?

Loan term length is how long you take to repay the loan (often 24–84 months depending on lender and amount). The term affects:

- monthly payment size, and

- total interest paid over time.

3 year vs 5 year personal loan (what actually changes?)

This answers your tail: “3 year vs 5 year personal loan.”

Monthly payment

- 5-year term usually lowers the payment because you spread principal over more months.

Total interest

- 5-year term usually increases total interest because you pay interest for longer.

Risk

- 3-year term is higher monthly pressure.

- 5-year term is higher long-term cost (and you stay in debt longer).

Shorter term vs lower payment (how to choose)

This answers your tail: “shorter term vs lower payment.”

Use this decision rule:

Rule #1: Payment must be survivable

If the payment is tight enough that one bad month makes you late, don’t do it. Late payments cost more than interest savings.

If you’re not sure what “survivable” looks like, check affordability via DTI and budget buffer.

Dti for personal loans.

Rule #2: After survivability, go shortest

Once the payment is safe, choose the shorter term to reduce total interest.

Rule #3: Avoid “payment bait”

Don’t pick a long term just because it looks comfortable if it pushes your total cost way up.

Total interest by term (why term length matters so much)

This answers your tail: “total interest by term.”

Total interest depends on:

- APR,

- loan amount,

- term length,

- payment schedule.

Even with the same APR, a longer term usually increases total interest because more interest accrues over more months.

APR basics: personal loan apr explained

Offer comparisons: how to compare loan offers

Table: Shorter vs longer term (tradeoffs)

| Term choice | What you gain | What you pay for it | Best for |

|---|---|---|---|

| Shorter term (e.g., 3 years) | Lower total interest, faster payoff | Higher monthly payment | Strong budget buffer |

| Longer term (e.g., 5 years) | Lower monthly payment | Higher total interest, slower payoff | Need affordability first |

| Too-long term | “Easy” payment | You overpay and stay in debt | Usually a trap |

How to choose your personal loan term (step-by-step)

Step 1: Pick your “payment ceiling”

What’s the max payment you can handle with buffer after essentials?

Step 2: Compare 2–3 term options

For each term, write:

- monthly payment

- total interest

- total repaid

Use this guide for clean comparisons:

how to compare loan offers

Step 3: Select the shortest term under your ceiling

If the 3-year payment fits safely, it often wins on total cost. If it’s tight, take the next shortest.

Step 4: If you’re consolidating debt, run the “behavior check”

A longer term might “work,” but only if you stop re-borrowing. Otherwise you create two debts instead of one.

debt consolidation loans

If you need a longer term to qualify (watch the hidden cost)

Sometimes the only way to get approved is choosing a longer term because it lowers payment and improves DTI math. That can be valid—but don’t stop there.

If you take a longer term:

- plan to make extra principal payments when possible (if no prepayment penalty), and

- consider refinancing later if your credit improves.

Early payoff and refi guide: early payoff refinance

Fees check (prepayment penalties): personal loan fees

Common mistakes

- Choosing the longest term automatically because the payment “looks easy.”

- Choosing the shortest term and then missing payments (worse outcome).

- Not checking prepayment penalties (blocks early payoff strategy).

Personal loan fees. - Consolidating debt into a longer term without stopping card spending.

Debt consolidation loans.

Examples / scenarios

Scenario 1: “I can afford the 3-year payment, but it’s tight.”

If it’s tight, it’s risky. A 5-year term can be smarter if it prevents late payments. Then pay extra principal when you can.

Early payoff refinance.

Scenario 2: “I want the lowest payment possible.”

Lowest payment usually means highest total interest. If you choose it, do it knowingly and plan an early payoff strategy.

Early payoff refinance.

Scenario 3: “I’m consolidating credit card debt.”

Shorter term can save a lot, but only if the payment fits and you stop re-borrowing.

Debt consolidation loans.

FAQ

What is a good personal loan term length?

A “good” term is the shortest one you can pay comfortably with a buffer. Shorter terms usually reduce total interest.

Is a 3-year loan better than a 5-year loan?

Often yes in total cost, because you usually pay less interest. But if the 3-year payment risks late payments, the 5-year term can be safer.

How does term length affect total interest?

Longer terms usually increase total interest because interest accrues over more months.

Should I choose a longer term to get approved?

Only if it makes the payment truly affordable. Then consider extra principal payments or refinancing later.

Early payoff refinance

Can I pay off a longer-term loan early?

Usually yes, but check for prepayment penalties first.

Personal loan fees

Related guides

- How to compare offers — /personal-loans/how-to-compare-loan-offers/

- APR explained (real cost) — /personal-loans/personal-loan-apr-explained/

- Fees to watch — /personal-loans/personal-loan-fees/

- DTI: what lenders want — /personal-loans/dti-for-personal-loans/

- Early payoff & refinancing — /personal-loans/early-payoff-refinance/