Where to go next

- Personal Loans hub

- APR explained (real cost)

- Fees to watch

Most people compare loans by the monthly payment. That’s how they get trapped in longer terms, higher total interest, and fees they didn’t factor in. The clean way is simple: compare total cost and terms first, then check whether the payment is sustainable.

This guide gives you a loan comparison checklist you can use to compare offers fast without missing the stuff that actually matters.

Quick answer / Key takeaways

- Compare loans by total dollars repaid (interest + fees), not just monthly payment.

- Use APR as a shortcut, but always confirm fees and net funding.

- Term length changes total interest massively—shorter term usually costs less overall.

- If you’re consolidating debt, the loan only “works” if you stop re-borrowing.

- Prequalify first, then apply to 1–2 best offers to avoid inquiry spam.

Prequalify soft pull

The 5 numbers you must compare (every time)

If you only compare five things, compare these:

- APR (real cost signal)

- Term length (how long you’re in the deal)

- Monthly payment (budget survivability)

- Fees (origination, late, prepayment penalty)

Origination fee explained. - Total cost (total repaid over the term)

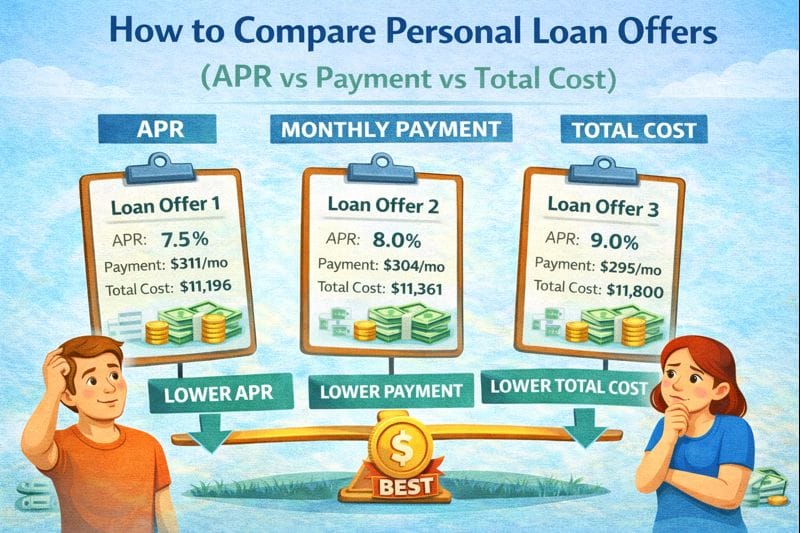

Compare APR vs payment vs total cost (what each tells you)

APR

Best for quickly comparing offers when fees exist. Not perfect, but useful.

Personal loan apr explained.

Monthly payment

Best for budgeting, worst for choosing a deal (because it can hide total cost).

Total cost

The final truth: how many dollars leave your life if you follow the schedule.

Table: Loan offer comparison (copy/paste into your brain)

| Metric | What it answers | What can go wrong if you ignore it |

|---|---|---|

| APR | “How expensive is this per year?” | Fees hide in the fine print |

| Term length | “How long am I paying?” | Longer term = more total interest |

| Monthly payment | “Can I survive this every month?” | Low payment can mean high total cost |

| Fees | “What extra costs exist?” | Origination/prepayment traps |

| Net funding | “How much cash do I actually receive?” | “Funded minus fee” shock |

| Total repaid | “What’s the true price?” | You pick the wrong ‘cheap’ loan |

Step-by-step: how to compare loan offers (fast and clean)

Step 1: Put offers into the same format

For each offer, write:

- loan amount

- term (months)

- APR + interest rate

- monthly payment

- origination fee (and whether it’s deducted)

- any prepayment penalty

- total amount repaid (if shown)

Step 2: Confirm origination fee and net funding

Ask: “How much will hit my bank account?”

Origination deep dive: origination fee explained.

Step 3: Compare total cost for the same term

If two offers have the same term:

- lower total cost usually wins (assuming payment fits).

Step 4: Compare the term tradeoff (3-year vs 5-year)

If one is 36 months and one is 60 months, don’t compare payments directly—compare:

- total interest paid

- total cost

- how risky the payment is for your budget

Loan term length.

Step 5: Sanity-check the payment against your budget

A loan that “barely fits” is a future late payment. Late payments cost more than APR differences.

If you’re stretched, check DTI logic:

Dti for personal loans.

Step 6: If it’s debt consolidation, run the consolidation reality check

A consolidation loan only wins if:

- the new payment is sustainable, and

- you stop new card spending.

Debt consolidation math: debt consolidation loans.

Alternative path (if you qualify): balance transfer vs personal loan.

Loan comparison checklist (use before you sign)

Offer structure

- Is the APR fixed or variable?

- Is the payment fixed for the full term?

- Is there an origination fee? How is it charged?

- Is the disbursement “funded minus fee”?

Cost and flexibility

- What is the total amount repaid over the full term?

- Is there a prepayment penalty?

Early payoff refinance. - What happens if you’re late (late fee rules, grace period)?

Risk and fit

- Does this payment fit even in a bad month?

- Will you still have a buffer after essentials?

- If consolidating: what rule stops you from re-borrowing?

Common mistakes (that make people overpay)

- Picking the lowest payment and accidentally buying the longest term.

- Ignoring origination fees and net funding.

- Not checking prepayment penalties (then paying a fee to do the “smart” thing).

- Applying everywhere and stacking inquiries because you didn’t prequalify.

Prequalify soft pull. - Consolidating without behavior change (most common failure).

Debt consolidation loans.

Examples / scenarios

Scenario 1: Two offers, same payment, different term

If the longer term looks “easier,” check total cost. The “easy” loan often costs far more overall.

Loan term length.

Scenario 2: One offer has a lower rate but an origination fee

Compare net funding and total dollars repaid. The fee can flip the winner.

Origination fee explained.

Scenario 3: You’re consolidating cards

Pick the deal that lowers cost and locks you into a payment you can sustain. Then remove the ability to re-borrow (no swiping, no new balances).

Debt consolidation loans.

FAQ

What’s the best way to compare personal loan offers?

Compare APR, fees, term length, monthly payment, and total cost—then choose the lowest total cost that fits your budget.

Should I compare loans by APR or by payment?

Start with APR, but decide based on total cost and term. Payment alone can hide expensive long-term cost.

What fees matter most when comparing loans?

Origination fees, prepayment penalties, and late fees.

Personal loan fees.

How do I compare offers if terms are different?

Compare total cost and total interest, not payment. A longer term often costs more overall.

Loan term length.

Does prequalifying affect credit?

Usually no if it’s a soft pull. Hard inquiries usually happen at application.

Prequalify soft pull.