Where to go next

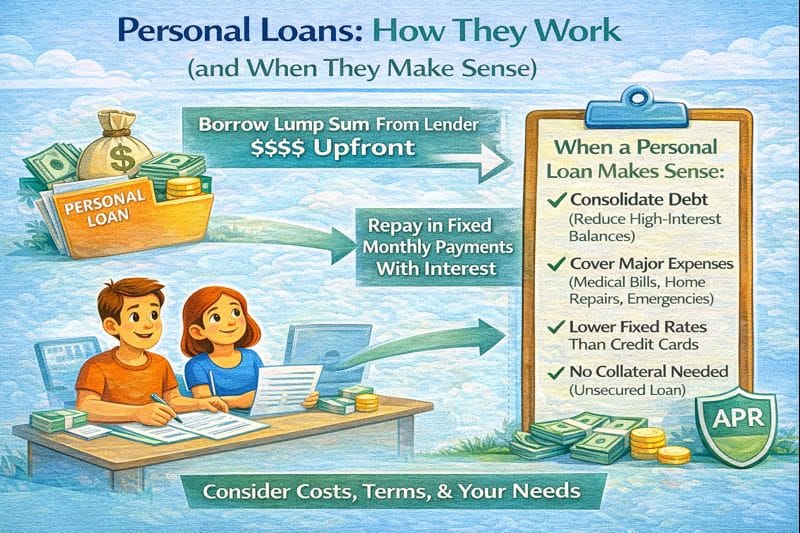

A personal loan is a fixed amount of money you borrow and repay in fixed monthly payments over a set term (often 2–7 years). It can be a clean tool for consolidation or a planned expense—but it can also be an expensive trap if you borrow without doing the math.

This page explains what a personal loan is, how personal loans work step-by-step, and the real pros and cons so you don’t get sold the wrong deal.

Quick answer / Key takeaways

- A personal loan is typically fixed payment + fixed term (predictable payoff date).

- The real cost is APR + fees, not the advertised “rate.”

- Best use cases: debt consolidation with discipline, major planned expenses, predictable payoff.

- Worst use cases: covering overspending, borrowing without fixing cash flow, rolling debt into a longer term.

- Prequalification can let you shop with a soft pull: prequalify soft pull.

- Always compare offers by total cost, not just monthly payment: how to compare loan offers.

What is a personal loan?

A personal loan is an installment loan: you borrow a lump sum, then pay it back in equal monthly payments (principal + interest) until it’s paid off.

Most personal loans are:

- unsecured (no collateral), or

- secured (backed by collateral, less common).

Full breakdown: secured vs unsecured.

How do personal loans work? (step-by-step)

This is the clean “how it works” flow.

Step 1: You apply (or prequalify)

Prequalifying often shows estimated offers without a hard pull.

Prequalify soft pull.

Step 2: Lender sets your pricing

Your offer is based on risk and affordability: credit, income, debts, and requested term.

Credit score basics for loans: credit score needed.

DTI basics: dti for personal loans.

Step 3: You choose term + amount

- Longer term = lower payment, usually higher total interest

- Shorter term = higher payment, usually lower total interest

Term guide: loan term length.

Step 4: You receive funds (funding)

Some lenders deduct an origination fee from the payout (you receive less than the “loan amount”).

Origination fee explained: origination fee explained.

Step 5: You repay in fixed monthly payments

Payments are due monthly. Missed payments can cause fees and credit damage.

Fees to watch: personal loan fees.

Table: Personal loan vs other common options

| Option | Best for | Payment style | Big risk | When it’s smarter |

|---|---|---|---|---|

| Personal loan | Predictable payoff, consolidation | Fixed monthly payment | Borrowing too much / too long | When APR is reasonable and budget supports payment |

| Credit card minimum payments | Short-term flexibility | Variable | Debt drags for years | Only if you can pay down fast |

| 0% balance transfer | Fast payoff with strong credit | Usually fixed minimum | Promo ends, fees apply | When you can clear balance before promo ends |

| Debt management plan (DMP) | Structured payoff with interest relief | One structured payment | Needs consistency | If you can repay but APR is crushing you |

If you’re deciding between transfer vs loan for card debt:

balance transfer vs personal loan.

Personal loan APR (what it really means)

APR is the cost of borrowing expressed yearly and can include certain fees in addition to interest. That’s why APR is the better comparison tool than a headline “rate.”

Deep dive: personal loan apr explained.

Personal loan pros and cons (no sales pitch)

Pros

Predictable payoff

You get a clear end date, unlike revolving credit.

Can reduce interest vs credit cards

If you qualify for a lower APR, consolidation can stop the interest bleed.

One payment

Easier to manage than juggling multiple minimums.

Cons

It’s easy to “stretch” debt

A longer term can lower the payment while raising total cost.

Fees can change the deal

Origination fees, late fees, and prepayment penalties can matter.

Personal loan fees.

You can end up with more debt

If you consolidate cards but keep spending, you’ve doubled the problem.

When a personal loan makes sense (and when it doesn’t)

Good fit

- You have high-interest card debt and can stop re-borrowing.

- You want a fixed payoff plan and the payment fits your budget.

- You’re comparing offers by total cost and choosing a term you can actually sustain.

Debt consolidation loan guide: debt consolidation loans.

Bad fit

- You’re using a loan to cover a cash-flow hole that will still exist next month.

- You’re choosing a longer term just to “make the payment work.”

- You’re looking at “no credit check” or “guaranteed approval” deals.

Avoid the traps: no credit check loans scams.

How to apply the smart way (so you don’t get cooked)

Step 1: Set your target payment first

Pick a monthly payment you can make even in a rough month. If the loan only “works” on perfect months, it’s a bad loan.

Step 2: Prequalify and collect real offers

Use prequal to shop without unnecessary damage.

Prequalify soft pull.

Step 3: Compare offers by total cost

Compare:

- APR

- total interest over the term

- fees

- monthly payment

Checklist: how to compare loan offers.

Step 4: Choose term based on total interest, not comfort

Term guide: loan term length.

Step 5: Confirm fees and penalties before signing

Fee guide: personal loan fees.

Step 6: If it’s consolidation, close the leak

If you’re paying off cards:

- stop using them during payoff, or set strict rules,

- don’t treat “available credit” as money.

Common mistakes

- Comparing only monthly payments (ignoring total cost).

- Taking a longer term to “feel better” now (and paying more later).

- Ignoring origination fees (net funding shock).

- Applying everywhere and stacking hard inquiries.

Hard inquiry impact: hard inquiry impact. - Using a high-APR bad credit loan when a safer alternative exists.

Bad credit personal loans.

Examples / scenarios (If X → do Y)

Scenario 1: “I want to consolidate credit card debt.”

Do the math first: if the personal loan APR is meaningfully lower and you can stop card spending, it can work.

Start here: debt consolidation loans.

Compare vs balance transfer: balance transfer vs personal loan.

Scenario 2: “I just need a lower monthly payment.”

Lower payment can be a trap if it comes from a longer term. Compare total cost by term.

Loan term length.

Scenario 3: “My credit isn’t great.”

Don’t jump on “guaranteed approval” offers. Look at realistic alternatives and avoid predatory setups.

Bad credit personal loans.

No credit check loans scams.

FAQ

What is a personal loan?

A personal loan is an installment loan where you borrow a lump sum and repay it in fixed monthly payments over a set term.

How do personal loans work?

You apply, the lender offers terms (APR, fees, term), you receive funds, then repay monthly until paid off.

Is APR the same as interest rate?

Not always. APR reflects the annual cost of borrowing and can include certain fees.

Personal loan apr explained.

What are the pros and cons of personal loans?

Pros: predictable payoff, potentially lower interest, one payment. Cons: fees, longer-term cost, and risk of re-borrowing.

Should I prequalify first?

Usually yes, because it can let you shop offers with a soft pull.

Prequalify soft pull.

What’s the safest way to compare personal loan offers?

Compare APR, fees, term, and total cost—not just the monthly payment.

How to compare loan offers.