Where to go next

A hard inquiry is what happens when you submit a real loan application and the lender checks your credit for a lending decision. People fear it because it can drop your score. But the bigger danger is not one hard pull—it’s applying everywhere and stacking them because you didn’t shop correctly.

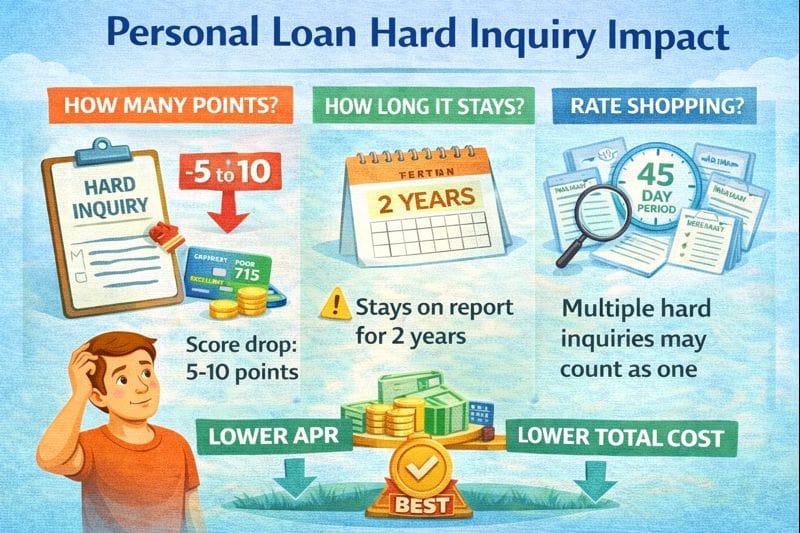

This guide explains hard inquiry impact for personal loans, how many points it can drop, how long hard inquiries stay, and how rate shopping windows can reduce the damage when you shop strategically.

Quick answer / Key takeaways

- A personal loan application typically triggers a hard inquiry.

- A hard inquiry can cause a small, usually temporary score drop, but stacking many can hurt more.

- Hard inquiries stay on your report for up to 2 years, but their scoring impact fades sooner.

- Rate shopping can treat multiple inquiries as one (depending on scoring model and timing), but you still shouldn’t spam applications.

- Best move: prequalify first, then apply to 1–2 top offers.

Prequalify soft pull.

What is a hard inquiry?

A hard inquiry is a credit check tied to a credit application (loan, card, etc.). It signals you’re seeking new credit, which can increase perceived risk in the short term.

A soft inquiry is different: it’s often used for prequalification and typically doesn’t affect your score the same way.

Prequalify soft pull.

How many points does a hard inquiry drop?

This answers your tail: “how many points hard inquiry.”

There’s no single exact number because it depends on your profile:

- thick/strong files often see smaller movement

- thin files can see larger swings

- recent inquiries and new accounts amplify the impact

Practical reality: One hard inquiry is usually not the end of the world. Multiple inquiries in a short time can be.

If your main goal is better loan pricing, focus on the variables that matter more than one inquiry: APR, fees, and term.

Personal loan apr explained.

Personal loan fees.

Loan term length.

How long do hard inquiries stay?

This answers your tail: “how long hard inquiries stay.”

Hard inquiries can remain on your credit report for up to 2 years. Scoring impact is typically strongest early and fades with time.

Practical takeaway: you don’t want a cluster of inquiries in the recent window if you’re planning a mortgage, auto loan, or another major credit move.

Rate shopping window for personal loans (how it works)

This answers your tail: “rate shopping window personal loan.”

Rate shopping is the idea that multiple inquiries for the same type of credit within a short window may be treated as one inquiry for scoring purposes (depending on the scoring model used).

The correct way to use this

- Do your shopping in a tight window.

- Don’t drag applications out over weeks.

- Still keep applications limited—because lenders see inquiries even if scoring models group them.

Most people don’t need to test rate shopping the hard way. Prequalify first, shortlist, and apply only where the deal is strong.

Table: Soft pull vs hard pull (what changes)

| Credit check type | When it happens | Score impact (typical) | Best use |

|---|---|---|---|

| Soft pull | Prequalify / account review | Usually none | Shopping offers safely |

| Hard inquiry | Full application | Small to moderate, usually temporary | Final approval decision |

How to minimize hard inquiry impact (step-by-step)

Step 1: Prequalify first

Get estimated offers without hard pulls.

Prequalify soft pull.

Step 2: Compare offers on the real metrics

APR, fees, term length, total cost.

How to compare loan offers.

Step 3: Apply to 1–2 best options

Don’t apply “just to see.” Your report remembers.

Step 4: Don’t open multiple new accounts at once

Inquiries plus new accounts together can hit harder than inquiries alone.

Step 5: Choose a term you can sustain

A too-tight payment causes late payments, and that’s far worse than inquiries.

Loan term length.

When hard inquiries matter more

Hard inquiries matter more if:

- you have a thin credit file

- you’ve applied for multiple accounts recently

- you’re about to apply for a major loan soon

- your score is near a pricing/approval threshold (small changes can affect APR)

Credit score and approval basics: credit score needed.

Common mistakes

- Applying to five lenders because you didn’t prequalify.

- Comparing only monthly payment and ignoring total cost (then applying again).

- Applying repeatedly after denial without fixing the reason (often DTI or income verification).

DTI guide: dti for personal loans.

Requirements: personal loan requirements documents. - Taking a high-cost loan because “I don’t want another inquiry.” (That’s backwards. One inquiry is cheaper than years of extra interest.)

Examples / scenarios

Scenario 1: “I don’t want my score to drop.”

Use prequalification first, then apply only once you’re confident in the deal.

Prequalify soft pull.

Scenario 2: “I applied twice and got denied.”

Stop applying. Find the blocker: DTI, income verification, or credit issues—then fix that first.

Dti for personal loans.

Personal loan requirements documents.

Scenario 3: “I’m shopping offers.”

Do it in a tight window and keep applications limited. Rate shopping helps, but discipline helps more.

FAQ

Does a personal loan application require a hard inquiry?

Usually yes. Prequalification may use a soft pull, but a full application typically triggers a hard inquiry.

How many points will a hard inquiry drop my score?

It varies. Often it’s a small, temporary drop, but it can be larger for thin credit files or when multiple inquiries stack up.

How long do hard inquiries stay on your credit report?

Up to 2 years, with the strongest impact early.

What is the rate shopping window?

It’s a period where multiple inquiries for the same type of credit may be grouped for scoring, depending on the scoring model and timing.

How do I shop personal loans without too many hard pulls?

Prequalify first, compare offers, then apply only to the top 1–2 options.

How to compare loan offers.