Where to go next

If your credit score is “fine” but you keep getting denied—or approved only at ugly APR—DTI is often the reason. DTI is lenders’ quick reality check: “How much of your income is already spoken for by debt payments?”

This guide explains what DTI lenders want for a personal loan, how to calculate DTI, and practical ways to lower DTI to qualify.

Quick answer / Key takeaways

- DTI = your monthly debt payments ÷ gross monthly income.

- Lower DTI usually means better approval odds and pricing.

- Paying down revolving balances can improve both DTI perception and credit utilization.

- Don’t apply repeatedly if DTI is the blocker—fix DTI first, then shop via prequalify.

Prequalify soft pull. - Lenders may also look at “cash flow” and residual income, not just DTI.

What is DTI (debt-to-income ratio)?

DTI is the percentage of your gross monthly income that goes to monthly debt obligations.

What counts as “monthly debt payments” (typical)

- credit card minimum payments

- auto loan payments

- student loan payments

- mortgage or rent (some lenders include housing in their affordability model)

- personal loan payments

- other installment debts

What often doesn’t count the same way

- utilities, groceries, subscriptions (not “debt,” but still part of your real budget)

That’s why you can “pass DTI” but still not afford the payment. You need both: lender DTI and your real-life budget.

DTI calculation (how to calculate DTI)

This answers your tail: “DTI calculation.”

Step 1: Add up monthly debt payments

Use minimum payments (not balances). Example:

- credit cards: $200 total minimums

- auto loan: $350

- student loan: $250

Total monthly debt payments = $800

Step 2: Find gross monthly income

Gross = before taxes. Example:

- $60,000/year ÷ 12 = $5,000/month

Step 3: Divide and convert to percent

DTI = $800 ÷ $5,000 = 0.16 = 16%

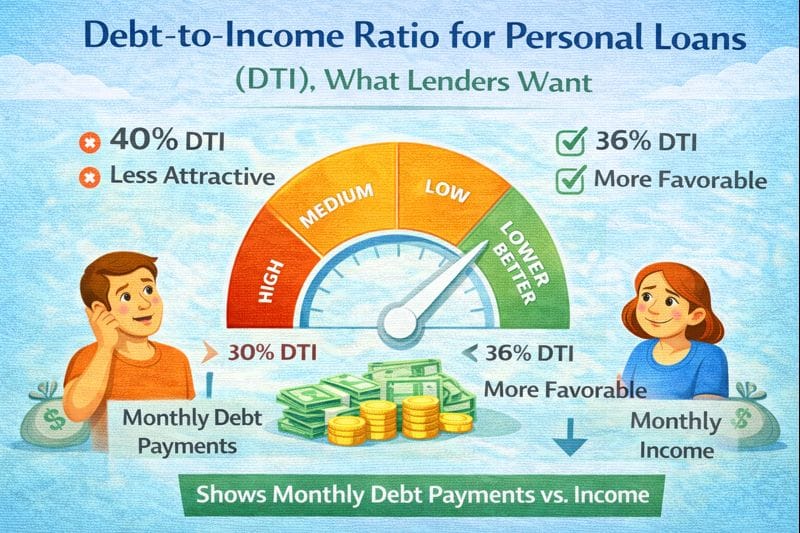

What DTI do lenders want for a personal loan?

This answers your tail: “what DTI do lenders want.”

There’s no universal cutoff, but the practical truth:

- lower DTI = easier approval + better pricing

- higher DTI = more denials, smaller loan amounts, higher APR, stricter terms

What lenders are really asking

“After we add this new loan payment, does your total monthly debt load still look safe?”

So even if your DTI is acceptable today, a large loan payment can push you into a denial zone.

Term length affects payment size directly:

loan term length.

Why DTI matters even more than score sometimes

Credit score is a risk signal. DTI is an affordability signal.

A lender might approve:

- a slightly lower score borrower with low DTI, stable income, and clean history

…and deny:

- a higher score borrower who is already stretched with high debt payments.

Table: DTI level → what it often means for approvals

| DTI level (general) | What it signals | Common outcome |

|---|---|---|

| Low | Strong affordability buffer | Better odds + better pricing |

| Medium | Manageable but tighter | Approval depends on lender/terms |

| High | Payment stress risk | Denials or high-APR approvals |

| Very high | Little room for new payment | Often denied or offered small/high-cost loans |

(Use this as a direction indicator, not a promise. Lenders weight DTI differently.)

How to lower DTI to qualify (real moves)

This answers your tail: “how to lower DTI to qualify.”

Step 1: Pay down revolving debt (credit cards)

This can lower minimum payments and improve utilization (which can help your score too).

Utilization tactics: credit utilization.

Step 2: Increase income (even temporarily) with proof

Overtime, a side contract, or a second job can help if it’s documentable and stable enough for underwriting.

Step 3: Reduce the loan payment you’re asking for

DTI is sensitive to payment size. You can reduce payment by:

- borrowing less, or

- choosing a longer term.

But longer term increases total interest—don’t trade approval for getting cooked long-term.

Loan term length.

Step 4: Pay off (or refinance) an existing installment debt

If you remove one payment, DTI improves immediately. This is especially effective with smaller loans that are close to paid off.

Step 5: Avoid stacking new obligations

New credit cards, new car loans, and repeated applications can worsen your profile fast.

Hard inquiry impact: hard inquiry impact.

DTI vs “real budget” (don’t ignore this)

Even if DTI passes, you need a safety buffer. A personal loan payment that “barely fits” is how people end up late—and late payments do real damage.

If you’re not sure what payment is safe, compare offers and total cost first:

how to compare loan offers.

Common mistakes

- Using net income instead of gross income for DTI (lenders usually use gross).

- Forgetting credit card minimum payments.

- Taking a longer term just to pass DTI, then paying far more total interest.

- Applying repeatedly instead of lowering DTI first.

- Consolidating debt but keeping card spending, which raises DTI again.

Debt consolidation math guide: debt consolidation loans.

Examples / scenarios

Scenario 1: “My score is solid but I keep getting denied.”

Your DTI is likely high after housing and existing debts. Lower revolving debt first, then prequalify.

Prequalify soft pull.

Scenario 2: “I can qualify only if I choose a 5-year term.”

That may pass DTI, but compare total interest vs a shorter term.

Loan term length.

Scenario 3: “I want a consolidation loan.”

Make sure the new payment is lower and you stop new card spending, or DTI rebounds.

Debt consolidation loans.

FAQ

What is DTI for a personal loan?

DTI is your monthly debt payments divided by your gross monthly income. Lenders use it to judge affordability.

How do I calculate DTI?

Add your monthly debt payments, divide by gross monthly income, and convert to a percentage.

What DTI do lenders want?

It varies by lender, but lower DTI improves approval odds and pricing. The lender also considers the new loan payment’s impact.

How can I lower my DTI quickly?

Pay down credit cards (reduces minimums), reduce requested loan amount/payment, or increase documented income.

Does DTI matter more than credit score?

Sometimes. Score measures risk; DTI measures affordability. A high DTI can block approvals even with a decent score.