Where to go next

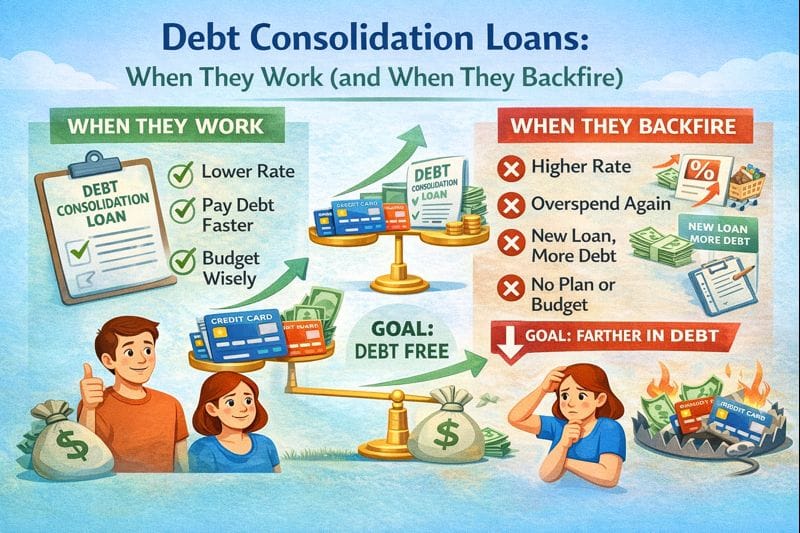

A debt consolidation loan is a personal loan you use to pay off multiple debts (usually credit cards) and replace them with one monthly payment. When it works, it lowers your interest, simplifies payments, and gives you a clear payoff date. When it fails, it fails the same way every time: you consolidate… then you keep using the cards.

This guide shows the real consolidation loan math, how to tell if it’s a good idea, and the exact steps to do it without making your situation worse.

Quick answer / Key takeaways

- Consolidation works when the new loan has meaningfully lower APR and the payment fits your budget with buffer.

- The “win” is not the monthly payment—it’s total cost and behavior control.

- If you consolidate but keep charging cards, you can end up with double debt.

- Fees matter: origination fees can reduce your payout (“funded minus fee”).

- Compare offers by APR + fees + term + total cost (not payment): how to compare loan offers

What is a debt consolidation personal loan?

A debt consolidation personal loan is a lump-sum loan used to pay off multiple debts. Most commonly:

- pay off credit card balances (and sometimes personal loans), then

- repay the consolidation loan in fixed monthly payments over a set term.

Personal loan basics: how personal loans work

Is consolidation a good idea? (the honest rule)

This answers your tail: “is consolidation a good idea.”

Consolidation is a good idea if these are true:

- APR drops enough to save real money,

- you can afford the payment every month without chaos,

- you have a plan to stop new card spending,

- you will actually use the funds to pay off the balances (not “some of them”).

Consolidation is usually a bad idea if:

- you’re choosing it only because “one payment feels nicer,”

- the payment is tight (one setback = delinquency),

- your credit/income only qualifies you for a similar or higher APR,

- you’re not ready to stop re-borrowing.

If you’re not sure you should consolidate at all, compare the broader options:

debt relief vs debt consolidation.

Consolidation loan for credit card debt (how it’s supposed to work)

The clean version looks like this:

- You get approved for a loan with lower APR than your cards.

- You use the loan to pay off card balances.

- You stop using the cards (or lock them down).

- You make one fixed payment until the loan is paid off.

If step 3 doesn’t happen, the whole plan becomes a trap.

Debt consolidation loan math (the 3 checks that decide everything)

This answers your tail: “consolidation loan math.”

Check #1: APR drop (is it real savings?)

If your cards are at high APR and the loan is meaningfully lower, consolidation can save money.

APR isn’t the rate—use APR to compare total cost:

personal loan apr explained.

Check #2: Payment survivability (can you sustain it?)

A lower APR doesn’t matter if the payment is too high and you miss payments.

DTI and affordability basics: dti for personal loans

Check #3: Total cost and term (are you buying “cheap payment” with expensive time?)

Longer terms often lower the payment but increase total interest.

Term tradeoff: loan term length.

Table: Consolidation loan decision matrix

| If your situation is… | Consolidation loan is… | Best move |

|---|---|---|

| You qualify for much lower APR and can stop card spending | Often a strong option | Compare offers by total cost and term |

| Payment is barely affordable | High risk | Borrow less or choose a safer path |

| APR is similar to your cards | Often not worth it | Look at balance transfer or other options |

| You’re already behind on cards | Harder to qualify | Compare alternatives and stabilize first |

| You can’t stop using the cards | Likely to backfire | Fix behavior/guardrails before consolidating |

Fees and “funded minus fee” (don’t get shorted)

If your loan has an origination fee, you may receive less than the loan amount. That matters for consolidation because you need enough cash to fully pay off balances.

Origination fee breakdown: origination fee explained

Full fee list: personal loan fees

How to do debt consolidation the right way (step-by-step)

Step 1: List every balance and minimum payment

Create one list with:

- creditor name

- balance

- APR

- minimum payment

- whether you’re current

Step 2: Pick a payoff target (exact dollars)

Your target is the amount needed to pay off the balances you’re consolidating.

Step 3: Prequalify first (avoid inquiry spam)

Prequalify to see likely offers before you apply.

Step 4: Compare offers using total cost

Don’t fall for “lowest payment.” Compare:

- APR

- fees (origination, late, prepay)

- term

- total repaid

How to compare loan offers

Step 5: Confirm net funding amount

If there’s a fee, confirm the amount that will actually hit your account.

Origination fee explained

Step 6: Pay off cards immediately (same day if possible)

This is where people mess up. If you hold the money, you’ll “borrow some of it” mentally.

Step 7: Lock down the cards (non-negotiable)

Pick one:

- freeze cards physically (or put them away),

- remove saved cards from online wallets,

- lower credit limits if needed,

- keep one card for emergencies only, with rules.

Step 8: Set autopay and a buffer

Autopay minimum is your safety net. Late payments are a bigger problem than small APR differences.

Consolidation vs balance transfer (quick reality check)

If you qualify for a 0% balance transfer, it can beat consolidation on cost—but only if you can pay it off before the promo ends.

Full comparison: balance transfer vs personal loan

Common mistakes (how consolidation turns into a mess)

- Consolidating and then running cards back up (most common).

- Choosing the longest term to get the lowest payment.

- Ignoring origination fees and coming up short on payoff amount.

- Applying everywhere (hard inquiries stack) instead of prequalifying first.

Prequalify soft pull. - Taking a loan to “fix spending” (a loan doesn’t fix behavior).

Examples / scenarios (If X → do Y)

Scenario 1: High credit card APR, stable income

If you can get a significantly lower APR and your payment fits with buffer, consolidation can be clean—then lock cards down immediately.

Scenario 2: You only qualify for high APR offers

If the loan APR is close to your card APR (or higher), consolidation likely won’t help. Compare a balance transfer or a different strategy.

Balance transfer vs personal loan.

Scenario 3: You’re consolidating but still tempted to swipe

Don’t consolidate until you install guardrails. Otherwise you’ll end up with the loan payment + new card balances.

FAQ

Can I use a personal loan to consolidate credit card debt?

Yes. Many borrowers use a personal loan to pay off multiple credit cards and replace them with one fixed payment.

Is a consolidation loan a good idea?

It can be—if the APR drops meaningfully, the payment fits your budget, and you stop new card spending.

How do I know if consolidation saves money?

Compare total cost: APR + fees + term + total repaid, then confirm net funding covers your payoff needs.

How to compare loan offers.

What if my consolidation loan has an origination fee?

Then you may receive less than the loan amount. Confirm net funding so you’re not short on payoff dollars.

Origination fee explained.

Will consolidation improve my credit score?

It can help if it lowers credit utilization and you pay on time, but results vary. The biggest win is stability and avoiding late payments.