Where to go next

People ask “what credit score do you need for a personal loan” because they’re trying to avoid two things:

- wasting hard inquiries on offers they won’t get, and

- getting approved only for a brutal APR.

This guide explains credit score expectations for personal loans, what “minimum credit score” really means in practice, and what to do if your score is low (without falling into predatory traps).

Quick answer / Key takeaways

- There isn’t one universal minimum score—approval depends on credit + income + debt-to-income (DTI).

- Lower scores can still get approvals, but often with higher APR and stricter terms.

- Prequalifying can help you shop offers with a soft pull: prequalify soft pull.

- The fastest “approval odds” improvements are often: lower utilization, fewer applications, stable income docs.

- If you’re seeing “no credit check / guaranteed approval” ads, treat them as high risk: no credit check loans scams.

What credit score do you need for a personal loan?

This answers your tail: “what credit score do you need for a personal loan.”

The honest answer

There’s no single cutoff. Lenders usually evaluate:

- credit score and report history,

- income and employment stability,

- DTI (how much of your income already goes to debt),

- recent inquiries and new accounts,

- the loan amount and term you request.

DTI guide: dti for personal loans.

Requirements and documents: personal loan requirements documents.

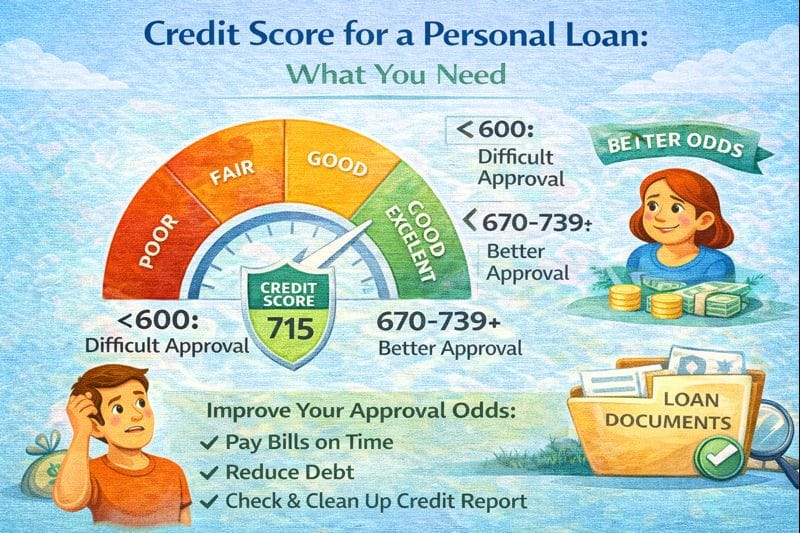

A practical way to think about ranges

Instead of chasing a magic number, think in tiers:

- Higher scores tend to qualify for lower APR and better terms.

- Mid-range scores may still qualify, but offers vary widely.

- Lower scores often face high APR, fees, and predatory pricing risk.

APR matters more than the headline rate:

personal loan apr explained.

Minimum credit score personal loan (what “minimum” really means)

This answers your tail: “minimum credit score personal loan.”

“Minimum score” marketing usually means:

- the lender is willing to approve some borrowers around that score if other factors look strong.

Common examples of “other factors” that can override a mediocre score:

- high, steady income,

- low DTI,

- strong payment history with few recent negatives,

- lower loan amount request,

- shorter term request.

Credit score is only one piece: what lenders really care about

1) Ability to repay (DTI and cash flow)

A lender may prefer a lower score borrower with low DTI over a higher score borrower who’s stretched thin.

dti for personal loans.

2) Recent credit behavior (inquiries and new accounts)

Multiple recent applications can signal risk and can lower your score temporarily.

Hard pull impact: hard inquiry impact.

3) Stability (income and documents)

If your paperwork is messy, approval can fail even with a decent score.

Personal loan requirements documents.

Table: Approval odds by profile (what usually helps)

| Profile factor | What it signals | How to improve it |

|---|---|---|

| Higher score / clean history | Lower default risk | Pay on time, avoid new lates |

| Low DTI | Room to handle payment | Pay down balances, increase income |

| Stable income docs | Predictable repayment | Gather paystubs, bank statements |

| Few recent inquiries | Not desperate for credit | Prequalify first, limit apps |

| Reasonable loan size | Lower risk exposure | Borrow only what you need |

| Shorter term (if affordable) | Faster payoff, less risk | Choose term deliberately |

How to improve approval odds (without wasting hard pulls)

Step 1: Prequalify first (soft pull path)

Prequalification can show potential offers without committing to a hard inquiry.

Prequalify soft pull.

Step 2: Clean up utilization (fast credit lever)

If revolving balances are high, lowering utilization can help your score and overall risk profile.

Utilization guide (practical): credit utilization.

Step 3: Reduce DTI if possible

Even small balance reductions can improve DTI and perceived affordability.

Dti for personal loans.

Step 4: Get your documents ready before you apply

Missing documents create delays or denials.

Personal loan requirements documents.

Step 5: Choose a realistic loan request

If you apply for too much money at too long a term, you might get denied or priced badly.

Loan term length.

If your score is low: what to do (and what to avoid)

Realistic options if you have bad credit

- Consider smaller loan amounts with affordable payments.

- Improve credit first if the offers are predatory.

- Compare alternatives if the APR is extreme.

Bad credit personal loans.

Avoid “no credit check” traps

If an ad says guaranteed approval, no credit check, or asks for upfront fees—treat it like a scam until proven otherwise.

No credit check loans scams.

Common mistakes

- Applying with multiple lenders back-to-back without prequalifying.

- Ignoring DTI and focusing only on score.

- Borrowing a larger amount “since I’m approved,” then getting stuck with a payment that breaks the budget.

- Taking a long-term high-APR loan because it feels like relief now.

Examples / scenarios

Scenario 1: “My score is okay but I keep getting offered high APR.”

Your DTI or recent inquiries might be the issue. Prequalify, compare offers by total cost, and reduce DTI if possible.

Dti for personal loans.

How to compare loan offers.

Scenario 2: “I’m borderline and don’t want to hurt my score.”

Prequalify first and avoid stacking hard pulls.

Prequalify soft pull.

Hard inquiry impact.

Scenario 3: “My credit is bad and I need money now.”

If offers are predatory, stop and compare realistic bad-credit options or alternatives. Don’t sign under pressure.

Bad credit personal loans.

No credit check loans scams.

FAQ

What credit score do you need for a personal loan?

There’s no universal score. Approval depends on your score plus income, DTI, and recent credit activity.

What is the minimum credit score for a personal loan?

“Minimum” varies by lender and usually isn’t a guarantee. Even if your score meets a stated minimum, other factors can still deny you or raise APR.

Can I get a personal loan with bad credit?

Sometimes, yes—but pricing can be expensive. Compare offers carefully and avoid predatory “guaranteed approval” deals.

Bad credit personal loans.

No credit check loans scams.

Will checking offers hurt my credit?

Prequalification often uses a soft pull and typically doesn’t hurt your score. A full application usually triggers a hard inquiry.

Prequalify soft pull.

Hard inquiry impact.

How can I increase my odds of approval?

Prequalify first, reduce utilization/DTI, prepare documents, and apply for a realistic amount/term.

Personal loan requirements documents.