Where to go next

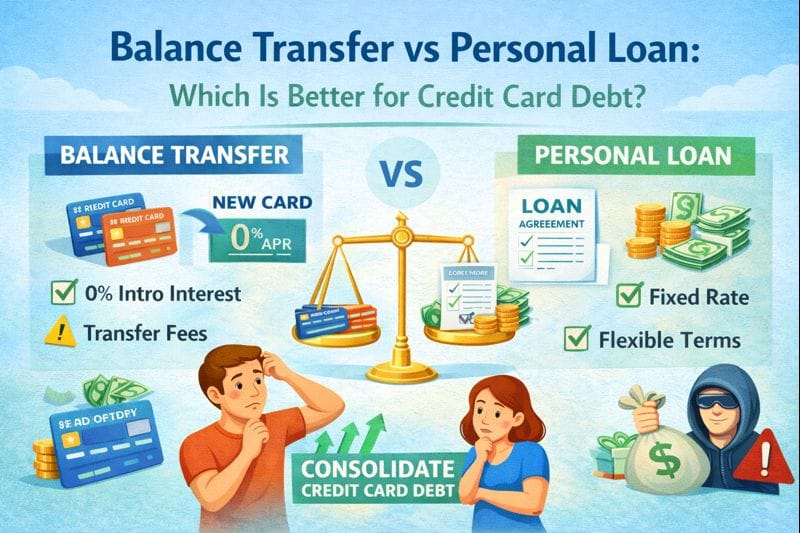

If you’re trying to get out from under credit card interest, the two most common “clean” options are:

- a 0% balance transfer card, or

- a personal loan used for consolidation.

Both can work. Both can fail. The winner depends on one thing: whether you can actually complete the payoff plan without re-borrowing.

This guide compares balance transfer vs personal loan, explains who qualifies for each, and shows how to choose based on cost, timeline, and risk.

Quick answer / Key takeaways

- A 0% balance transfer can be cheaper than a loan if you qualify and pay it off before the promo ends.

- A personal loan can be better if you need a fixed payoff schedule and predictable payments.

- Balance transfers often include a transfer fee; personal loans may include origination fees.

- Best option is the one you can finish—without running balances back up.

- Compare offers by total cost, not payment: how to compare loan offers

What is a 0% balance transfer?

A balance transfer is when you move existing credit card debt onto a new card, often with a promotional 0% APR period for a set number of months. During the promo, interest may be 0%—but you still have to make payments and follow the rules.

What is a personal loan for consolidation?

A personal loan for consolidation is a fixed-term loan you use to pay off credit card balances, replacing them with one installment payment.

Debt consolidation basics: debt consolidation loans

0% balance transfer vs loan: the real differences

This answers your tail: “0% balance transfer vs loan.”

Balance transfer (0% promo)

- Potentially very low interest cost during promo

- Usually requires good credit

- Risk: if you don’t finish before promo ends, costs can jump

Personal loan

- Fixed payment, fixed term (usually)

- Can work with wider credit profiles (pricing varies)

- Risk: origination fees and higher APR if credit is weaker

APR guide: personal loan apr explained

Fees guide: personal loan fees

Who qualifies (and what lenders look at)

This answers your tail: “who qualifies.”

Balance transfer cards

Often best for people with:

- stronger credit scores and cleaner history

- stable income and manageable utilization

- enough credit limit to cover the transfer amount

Hard truth: sometimes you get approved but with a limit too small to move your full balance.

Personal loans

Approval depends on:

Table: Balance transfer vs personal loan (side-by-side)

| Category | Balance transfer card | Personal loan |

|---|---|---|

| Best for | Strong credit + fast payoff plan | Predictable payoff + fixed payment |

| Interest cost | Can be low during 0% promo | Depends on APR |

| Fees | Often a transfer fee | Often origination fee + possible other fees |

| Payment structure | Minimum payment rules; you choose payoff speed | Fixed installment payment |

| Timeline | Promo period (months) | Term length (years) |

| Risk | Not paying off before promo ends; new card spending | Overpaying via long term or high APR |

| Behavior trap | “I freed up the old card, I can spend again” | “Payment feels manageable, I can swipe again” |

Which is better for credit card debt?

This answers your tail: “which is better for credit card debt.”

Balance transfer is usually better if…

- you qualify for a strong 0% offer,

- the transfer limit covers most/all of your balance,

- you can pay it off before promo ends,

- you won’t rack up new debt on the old cards.

Personal loan is usually better if…

- you need a fixed payoff schedule,

- you want one predictable payment,

- you can get a reasonable APR and fees,

- you need to consolidate multiple cards quickly.

The payoff math you should run (before you choose)

Step 1: Calculate how fast you can realistically pay

Pick a monthly amount you can pay with buffer.

Step 2: For balance transfer, check promo payoff feasibility

If the promo is 12–18 months, can your monthly payment clear the balance before it ends?

If not, the “0%” offer may not be the cheapest long-term plan.

Step 3: For personal loan, compare total cost and term

Compare:

- APR

- fees (origination, etc.)

- term length

- total repaid

Step 4: Choose the option you can complete without re-borrowing

This is where most people lose.

How to choose (simple decision flow)

- Can you qualify for a 0% balance transfer with enough limit?

- Yes → next question.

- No → personal loan may be the better route.

- Can you pay it off before promo ends?

- Yes → balance transfer often wins on cost.

- No → personal loan may be safer/predictable.

- Will you stop using your cards while paying off the debt?

- If no, neither option works. Install guardrails first.

Common mistakes

- Doing a balance transfer and then running balances back up on the old cards.

- Paying only minimums during 0% promo and getting trapped when promo ends.

- Taking a personal loan with origination fees and not comparing net cost.

- Choosing a longer loan term just to lower payment and then overpaying huge interest.

Examples / scenarios (If X → do Y)

Scenario 1: “I can pay this off in 12 months.”

If you qualify, a 0% balance transfer is often the cheapest—pay it aggressively and avoid new spending.

Scenario 2: “I need a fixed plan or I’ll drift.”

A personal loan can be better because the payment is fixed and payoff is scheduled.

Scenario 3: “I’m not sure I’ll finish before promo ends.”

A loan might cost more than 0% in theory, but less in real life if it prevents long-term revolving interest.

FAQ

Is a balance transfer better than a personal loan?

It can be cheaper if you qualify for 0% and pay it off before the promo ends. A personal loan can be better if you need fixed payments and a predictable payoff.

Do balance transfers have fees?

Often yes—many cards charge a balance transfer fee. Compare that fee against loan origination fees and total cost.

Do personal loans have fees?

Some do, especially origination fees. Always compare APR and net funding.

Origination fee explained

Which option is easier to qualify for?

Balance transfer cards typically require stronger credit. Personal loans can work across a wider range, but pricing may be high for weaker credit.

Credit score needed

What’s the biggest risk with both options?

Consolidating and then re-borrowing—ending up with the new payment plus new credit card debt.