Where to go next

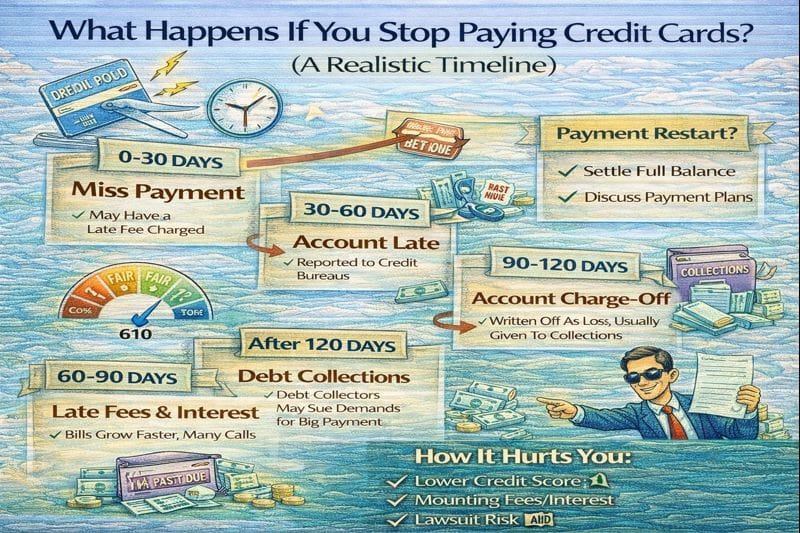

If you stop paying your credit cards, the process usually follows a predictable escalation: late fees and penalty APR, then delinquency reporting, then charge-off and collections, and sometimes lawsuits. The exact timing varies by creditor and state, but the overall timeline is consistent.

This guide explains what typically happens, when it happens, and what to do at each stage—especially if you’re choosing between hardship plans, a DMP, or settlement.

Quick answer / Key takeaways

- Missing one payment can trigger late fees and may trigger penalty APR depending on your terms.

- Once you’re about 30 days past due, the account can be reported as 30 days late (a major credit milestone).

- After months of nonpayment, accounts may be charged off and moved to collections.

- Collections often bring heavier contact and settlement offers—but it can also escalate.

- Some creditors or collectors may sue, depending on balance size, state rules, and strategy.

- If you can act early, start with a creditor hardship plan: creditor hardship programs.

Stop paying credit cards: consequences that can happen fast

Even before anything “official” happens, common quick consequences include:

- late fees stacking,

- interest continuing to accrue,

- minimum payments increasing (because balances rise),

- more calls/emails/mail from the issuer.

If you’re thinking “I’ll just pause payments for a couple months,” understand that a short pause can still create long-term credit reporting damage if you cross delinquency thresholds.

Credit card delinquency timeline (typical stages)

People search “charge-off meaning” and “collection account timeline” because they want the map. Here it is.

Timeline table (what happens + what to do)

| Stage | Typical timing | What usually happens | Best move |

|---|---|---|---|

| Missed payment | 0–29 days past due | Late fee; possible penalty APR; issuer contact starts | Call for hardship before you’re reported late: creditor hardship programs. |

| 30 days late | ~30+ days past due | First major delinquency reporting milestone | Get a plan fast (hardship/DMP): debt management plan dmp. |

| 60–90 days late | 2–3 months past due | Deeper delinquency reporting; more aggressive outreach; account restrictions | Decide if you can realistically get current; avoid wishful thinking |

| Charge-off | often after several months | Creditor treats the account as a loss; debt still owed; may be transferred/sold | Understand legal risk: credit card lawsuit garnishment. |

| Collections | after charge-off | Calls/letters; possible settlement offers; potential escalation | Keep records; avoid scams: debt relief scams red flags. |

Stage 1: Missed payment (0–29 days past due)

Common outcomes

- late fee assessed,

- possible penalty APR,

- issuer contact starts.

What to do now

Call and ask about hardship or a temporary payment plan before you’re reported late:

creditor hardship programs.

Stage 2: 30 days late (first major credit reporting milestone)

Common outcomes

- credit bureaus may receive a 30-day delinquency mark,

- issuer contact typically increases.

What to do now

Get a plan in place quickly: hardship, DMP, or another realistic option.

If you can repay but interest is killing you, review DMP basics:

debt management plan dmp.

Stage 3: 60–90 days late (delinquency deepens)

Common outcomes

- additional delinquency reporting,

- more aggressive outreach,

- account may be restricted/closed for new charges.

What to do now

Confirm whether you can realistically get current.

If you’re considering settlement, understand the workflow and risks first:

debt settlement how it works.

Stage 4: Charge-off (often after several months of nonpayment)

Charge-off meaning: the creditor treats the account as a loss for accounting purposes. This does not mean the debt disappears. You may still owe the balance, and collection may continue through the original creditor, a collection agency, or a debt buyer.

Common outcomes

- the account is charged off and may be transferred/sold,

- collections activity can intensify,

- settlement offers may become more common.

What to do now

Understand legal risk and what to do if you receive legal papers:

credit card lawsuit garnishment.

Stage 5: Collections (agency or debt buyer)

Collection account timeline: after charge-off, the debt may be collected by a third party. You may receive letters/calls, and the collector may try to negotiate.

What to do now

- keep records of all communication,

- don’t ignore court papers,

- be cautious with scams and shady “relief” pitches:

debt relief scams red flags.

Will they sue for credit card debt?

Sometimes, yes. Whether a creditor sues depends on factors like:

- your balance amount,

- your state,

- how easy it is to locate/serve you,

- the creditor/collector’s strategy and resources.

If you want the practical overview and what to do if sued, start here:

credit card lawsuit garnishment.

What you can do at each stage (damage control playbook)

If you are still current (or only slightly behind)

- Request a hardship plan: creditor hardship programs.

- Consider a DMP if you can repay principal but need lower rates: debt management plan dmp.

- If you can qualify and stay disciplined, compare consolidation: debt relief vs debt consolidation.

If you are 60–120 days behind

- Get clear on settlement mechanics before you commit: debt settlement how it works.

- Understand lawsuit risk and response basics: credit card lawsuit garnishment.

If you are in collections

- Organize documents and communication records.

- Watch for scams and “guaranteed relief” claims: debt relief scams red flags.

- Don’t ignore legal notices.

Common mistakes that make things worse

- Waiting until you’re deep delinquent before asking for help.

- Choosing a strategy based on a sales pitch instead of your budget.

- Assuming “charge-off” means you no longer owe the debt.

- Ignoring lawsuit warnings or court papers.

- Paying for shady services without understanding fees, timeline, and what happens if creditors refuse.

Examples / scenarios (If X → do Y)

Scenario 1: You missed one payment and want to stop the bleeding

Call and ask for hardship options before you hit 30 days late:

creditor hardship programs.

Scenario 2: You’re approaching 60 days late and minimums are impossible

If repayment might work with lower APR and structure, review a DMP:

debt management plan dmp.

Scenario 3: You’re deep delinquent and getting collection pressure

If you’re considering settlement, learn how it works and what the process involves:

debt settlement how it works.

Then read lawsuit basics so you’re not blindsided:

credit card lawsuit garnishment.

FAQ

What happens if you stop paying credit cards for 1 month?

You’ll likely face late fees, interest accrual, and increased contact attempts. If you cross 30 days past due, you may be reported delinquent.

What does “charge-off” mean on a credit card?

A charge-off is an accounting action where the creditor records the debt as a loss. It does not erase the debt, and collection attempts can continue.

How long before a credit card goes to collections?

It varies, but accounts often escalate after multiple missed payments and may be charged off after several months, then collected by agencies or debt buyers.

Can a credit card company sue you?

Yes, it can happen. If you’re worried, read: credit card lawsuit garnishment.

What should I do first if I can’t pay?

If you’re still early, start with a hardship request: creditor hardship programs.

If you need long-term structure, consider a DMP: debt management plan dmp.