Where to go next

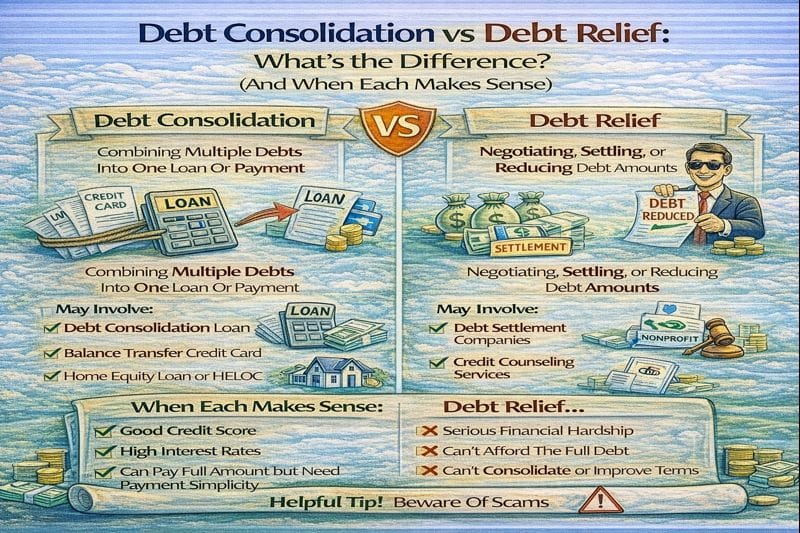

People mix these up because both can lower your monthly stress. But they’re not the same move.

- Debt consolidation = you replace multiple debts with one new payment (usually a loan or balance transfer).

- Debt relief = you change the terms of repayment without a new loan (common paths: hardship plans, a DMP, or debt settlement).

This guide helps you pick the right one based on your credit, your budget, whether you’re current, and how much risk you can tolerate.

Quick answer / Key takeaways

- If you can qualify for a lower rate and won’t run cards back up, consolidation can be the cleanest fix.

- If interest is the problem but you can repay principal, a DMP can lower rates without a new loan: debt management plan dmp.

- If you can’t afford minimum payments, you may be looking at higher-risk relief paths (including settlement).

- Debt consolidation is not the same as debt settlement (settlement negotiates to pay less).

- Best time to act is before you fall behind—once accounts go delinquent, options and costs change fast.

Definitions (so you don’t get sold the wrong thing)

What is debt consolidation?

Debt consolidation usually means:

- a personal loan that pays off several cards/loans, or

- a balance transfer card that moves high-interest balances to a lower promotional rate, or

- sometimes a home equity product (higher stakes because your home can be on the line).

The goal is one payment, ideally lower interest, and a clear payoff schedule.

What is debt relief?

Debt relief is an umbrella term for strategies that reduce your payment burden by changing terms, such as:

- Creditor hardship programs (temporary lower APR/payment): creditor hardship programs.

- Debt management plan (DMP) (structured repayment, often reduced APR): debt management plan dmp.

- Debt settlement (negotiate to pay less than owed, higher risk): debt settlement.

Debt consolidation vs debt relief (side-by-side comparison)

| Category | Debt consolidation (loan / balance transfer) | Debt relief (hardship / DMP / settlement) |

|---|---|---|

| Main idea | New credit replaces old balances | Terms change without a new loan |

| Best for | You qualify for better terms and can stay disciplined | You need affordability, structure, or reduction |

| Credit requirement | Usually requires decent credit/income | Some options work even with weaker credit |

| Monthly payment | Often fixed and predictable | Varies (hardship/DMP predictable; settlement less predictable) |

| Interest cost | Can be lower if you qualify | Can be lower (hardship/DMP) or uncertain (settlement) |

| Timeline | Depends on loan term / promo period | Hardship: months; DMP: often 3–5 years; settlement: often 24+ months |

| Risk level | Low–medium (main risk is re-borrowing) | Varies: hardship/DMP lower; settlement higher (collections/lawsuits possible) |

| Credit impact (typical) | Often neutral-to-positive if managed well | Varies: hardship/DMP moderate; settlement often heavier |

| Common failure mode | You consolidate, then run cards back up | You choose the wrong path for your budget reality |

“Is debt consolidation the same as debt settlement?”

No.

- Consolidation: you take a new loan or move balances to a new account, then repay as agreed.

- Settlement: you negotiate to resolve debts for less than owed (often after delinquency), with higher credit and collections risk.

If you’re considering settlement, read the mechanics first:

debt settlement.

When consolidation makes sense (and when it doesn’t)

Consolidation makes sense if…

- you can qualify for a meaningfully lower rate or better payment,

- the new monthly payment fits your budget with room to breathe,

- you have a plan to stop new debt (otherwise you double your problem),

- you’re still mostly current and want to avoid escalation.

Consolidation is a bad move if…

- the payment is barely affordable (one setback and you’re behind again),

- you’re using consolidation to “free up” cards and keep spending,

- your credit/income won’t qualify you for better terms,

- your main need is principal reduction (consolidation doesn’t reduce what you owe).

If interest is the main problem but you can repay principal, look at DMP first:

debt management plan dmp.

Consolidation loan vs debt relief: which is better? (decision path)

Step 1: Are you current on payments?

- Yes (current): consolidation or DMP/hardship are usually first.

- No (behind): consolidation approvals get harder; relief paths become more relevant.

If you’re behind and wondering what happens next, read:

stop paying credit cards what happens.

Step 2: Can you realistically repay 100% of principal?

- Yes: consolidation or DMP (choose based on qualification + discipline).

- No: you may need higher-impact relief options (including settlement).

Step 3: What’s your biggest constraint?

- High APR is the problem: consolidation or DMP.

- Cash flow is the problem (minimums impossible): hardship/DMP/other relief paths.

- Overspending is the problem: any product fails unless behavior changes (you need guardrails).

How to do debt consolidation the right way (so it actually works)

1) Run the “one number that matters”

Your target is a new payment you can sustain even on a bad month. If the consolidation payment is not clearly sustainable, don’t do it.

2) Compare total cost, not just the monthly payment

A longer term can lower the payment but increase total interest. Ask: “How much will I repay in total if I stick to the schedule?”

3) Avoid the classic trap: consolidating without closing the leak

If you consolidate and keep using the cards, you’re stacking debt. Set a hard rule: no new charges until you’re stable.

4) If consolidation doesn’t pencil out, pivot fast

- Temporary hardship? Try a creditor hardship plan: creditor hardship programs.

- Need structure + lower APR without a new loan? DMP: debt management plan dmp.

How to choose the right debt relief option (if you can’t consolidate)

If you can’t qualify for a good consolidation deal—or consolidation doesn’t reduce stress enough—use this hierarchy:

- Hardship plan if the problem is temporary and you want to stay current: creditor hardship programs.

- DMP if you can repay principal but need lower APR + structure: debt management plan dmp.

- Settlement only if full repayment isn’t realistic and you accept higher risk: debt settlement.

Before signing anything in the relief space, read scam red flags:

debt relief scams red flags.

Common mistakes (that make people worse off)

- Consolidating and then running cards back up (most common failure).

- Choosing a loan with fees/terms you don’t understand.

- Picking settlement when a lower-risk DMP would have worked.

- Waiting until you’re deep delinquent before doing anything.

- Signing with a company that uses pressure, guarantees, or vague pricing: debt relief scams red flags.

Examples / scenarios (If X → do Y)

Scenario 1: “My credit is still okay and I just need one sane payment.”

If you qualify for a lower-rate loan or a balance transfer and you can stop re-borrowing, consolidation is often the cleanest path.

Scenario 2: “I can repay, but APR is suffocating me.”

If your budget supports repayment once interest drops, a DMP can deliver structure and rate relief without a new loan:

debt management plan dmp.

Scenario 3: “Minimum payments are impossible.”

If you can’t cover minimums and you’re heading toward delinquency, understand consequences and choose a plan based on reality:

stop paying credit cards what happens.

FAQ

Debt consolidation vs debt relief: which is better?

Consolidation is often better if you qualify for meaningfully better terms and can stay disciplined. Debt relief is often better if you need lower payments through creditor concessions, structure, or (in higher-risk cases) reduction.

Is debt consolidation the same as debt settlement?

No. Consolidation is a new loan/transfer to repay as agreed. Settlement negotiates to pay less than owed and often involves delinquency and higher risk.

When does consolidation make sense?

When it lowers your rate or improves your payment meaningfully and you can avoid re-borrowing. If it doesn’t reduce stress or costs, it’s the wrong tool.

Does consolidation hurt your credit?

It depends on your situation and how you manage it. A new account/inquiry can cause short-term changes, but paying down revolving balances and staying on time can help over time.

What if I can’t qualify for consolidation?

Look at hardship plans or a DMP first. If repayment isn’t realistic, learn settlement mechanics and risks before committing:

debt settlement.