Where to go next

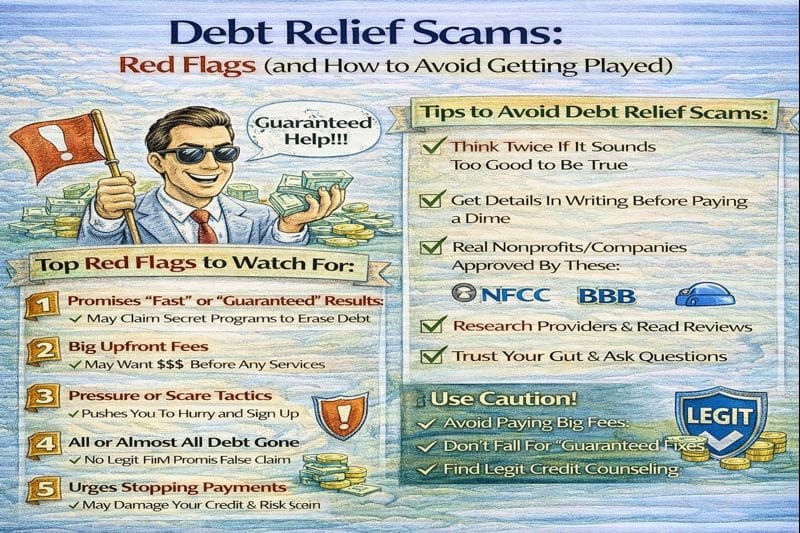

If you’re in debt, you’re a target. Scammers know you’re stressed and looking for a quick fix. Most “debt relief scams” don’t look like obvious fraud — they look like real companies with websites, “specialists,” and contracts. The trap is usually in the fees, the guarantees, and what they pressure you to do.

This guide gives you a clean filter: the red flags, what’s normal vs not, and a step-by-step checklist to verify any debt relief company before you pay a cent.

Quick answer / Key takeaways

- Upfront fees are a major red flag — especially if they charge before any debt is actually resolved.

- “Guaranteed” results (guaranteed savings/approval/settlement) are usually a sign to walk away.

- Pressure tactics (“today only,” “your wages will be garnished tomorrow”) are not how legit help operates.

- No written fee schedule + vague contract is where people get trapped.

- Safer starting points are often creditor hardship plans or a DMP — not a random “relief company.”

- If you already stopped paying, understand the real timeline first: stop paying credit cards what happens.

What “debt relief scam” usually looks like in real life

Most scams fall into a few repeatable patterns.

1) “Debt settlement” sales funnel pretending to be counseling

They call themselves “counselors,” but they only sell one thing: settlement. If they don’t review your budget and they rush you into signing, it’s not counseling.

Compare legit credit counseling here: credit counseling how to choose.

2) Lead-gen middlemen (you think you hired a company — you didn’t)

You call “Company A,” but your info gets handed to “Company B” (or multiple companies). Then you get spam calls and a hard sell.

3) Contract traps (fees, cancellation penalties, and “we already did work”)

Even when they technically provide some service, the contract can be designed so you lose money whether it works or not.

Debt settlement scam signs (most common red flags)

These are the “walk away” signals.

Red flag 1: Upfront fees before any debt is resolved

If they want money before they’ve resolved a single debt, treat that as a serious warning sign. Legit help is transparent about when fees are charged and what you’re paying for.

Red flag 2: Guarantees

Examples:

- “We guarantee we’ll cut your debt by 50%.”

- “Guaranteed approval.”

- “Guaranteed no lawsuits.”

No one can guarantee a creditor’s decision.

Red flag 3: They tell you to stop paying without explaining consequences

Stopping payments can trigger fees, credit damage, collections, and lawsuits. A legit provider explains the risks clearly and gives alternatives.

Start with the real consequences: stop paying credit cards what happens.

Legal risk overview: credit card lawsuit garnishment.

Red flag 4: Pressure tactics and fear scripts

- “You have to enroll today.”

- “We can’t hold this offer.”

- “They’ll garnish you tomorrow.”

Pressure is a control tool. You should be able to review paperwork calmly.

Red flag 5: Vague pricing

If you can’t clearly answer all of these, you’re walking into a trap:

- total fees,

- how they’re calculated,

- when you pay,

- what happens if a creditor refuses,

- what happens if you cancel.

Red flag 6: They avoid writing anything down

If they won’t provide a written fee schedule and a contract you can review, don’t sign.

“Upfront fees debt relief illegal?” (what this question really means)

When people ask this, they’re usually asking: “Is this normal or am I being scammed?”

Practical rule: if a company wants money up front, treat it as high risk. Pause, verify, and compare options before paying. Even if something is technically allowed, it can still be a bad deal for you.

Verification checklist (use this before you pay anyone)

Do this in order. It’s fast and it saves people thousands.

Step 1: Identify exactly who you’re dealing with

You need:

- the legal business name (not just a brand name),

- physical address and phone number,

- who will actually service the account (not a vague “partner”).

If they won’t clearly identify the servicing company, walk.

Step 2: Demand the written fee schedule

You need a written breakdown of:

- setup/enrollment fees (if any),

- monthly fees,

- any “success” or performance fees,

- cancellation terms and refund policy.

No written fees = no deal.

Step 3: Ask how they handle creditor refusal

Real question: “What if one or more creditors refuse to negotiate?”

If the answer is vague or magical, walk.

Step 4: Ask what happens to your money while you save

If they’re telling you to “save for settlements,” ask:

- where the money is held,

- who controls it,

- whether you can withdraw,

- what fees come out and when.

Step 5: Get clarity on credit and legal risk

A legit conversation includes:

- credit impact,

- collections pressure,

- lawsuit possibility,

- what you should do if served.

If they minimize all risk, it’s a pitch.

Legit help vs scam patterns (table)

| Signal | Legit provider pattern | Scam / high-risk pattern |

|---|---|---|

| Fees | Clear written fee schedule | Vague fees, “we’ll explain later” |

| Results | No guarantees | Guaranteed savings or approval |

| Pressure | You can review and decide | “Enroll today” fear scripts |

| Risk disclosure | Explains credit + legal risks | Downplays risk, promises certainty |

| Budget review | Reviews income/expenses/debts | Rushes you into signing |

| Paperwork | Written contract + cancellation terms | Refuses to send docs before payment |

| Company identity | Clear legal name + address | Hides who will service your account |

Safer alternatives (what to try before “debt relief companies”)

If you want less risk, start here.

Option 1: Creditor hardship programs (direct)

If your issue is temporary, a hardship plan can reduce APR or payments without a third-party contract.

Creditor hardship programs.

Option 2: Credit counseling + DMP (structured payoff)

If you can repay principal but need interest relief and structure, a DMP can be the safer route.

Debt management plan dmp.

Option 3: Consolidation (if you qualify and stay disciplined)

If you can get a lower rate and you won’t re-borrow, compare here:

debt relief vs debt consolidation.

Option 4: Settlement (only when repayment isn’t realistic)

If you truly can’t repay in full, learn how settlement actually works before signing anything:

debt settlement

Common mistakes that get people scammed

- Choosing based on a sales call instead of written terms.

- Paying before reading the contract.

- Believing guarantees.

- Confusing “nonprofit counseling” with “settlement sales.”

- Not understanding what happens if you stop paying: stop paying credit cards what happens.

Examples / scenarios (If X → do Y)

Scenario 1: They demand money today to “start the process”

If a company won’t let you review fees and terms first, walk. Start with safer paths:

creditor hardship programs

credit counseling how to choose.

Scenario 2: They guarantee they’ll cut your debt in half

Hard stop. No one controls creditor decisions. Compare real options first:

debt relief options.

Scenario 3: You’re already behind and you’re desperate

Desperation is where scams win. Slow down and read the escalation timeline and legal basics:

stop paying credit cards what happens

credit card lawsuit garnishment.

FAQ

What are the biggest debt relief scam red flags?

Upfront fees, guarantees, pressure tactics, vague pricing, refusal to provide written terms, and minimizing credit/legal risk.

Is it illegal for debt relief companies to charge upfront fees?

Even when rules differ by product and provider type, the practical takeaway is simple: upfront fees are a major red flag and require verification before you pay.

How do I verify a debt relief company?

Identify the legal entity, get a written fee schedule, confirm who services the account, ask what happens if creditors refuse, and demand clear risk disclosure.

Are nonprofit credit counseling agencies safer?

Often, yes—if they provide real budgeting help and transparent DMP terms. Use this selection guide:

credit counseling how to choose.

What’s a safer first step than hiring a “debt relief company”?

Start with a creditor hardship request or a DMP review:

creditor hardship programs

debt management plan dmp.