Where to go next

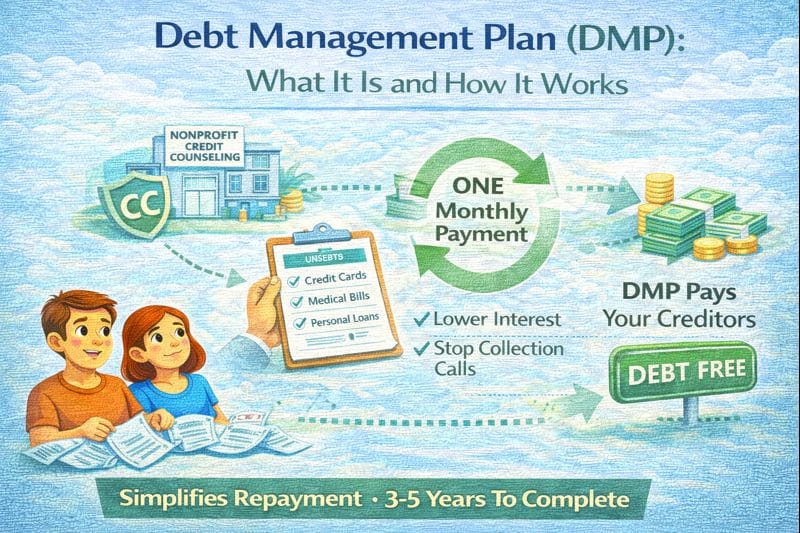

A debt management plan (DMP) is a structured payoff plan—usually set up through credit counseling—that can make high-interest debt manageable by lowering interest rates and organizing payments into one monthly amount. It’s typically designed for unsecured debt like credit cards, personal loans, and some medical bills.

This guide covers what a DMP is, how it works step-by-step, typical costs, and what to expect for your credit and timeline—so you can decide quickly if a DMP is the right debt relief option for you.

Quick answer / Key takeaways

- A DMP is usually a 3–5 year payoff plan with a single monthly payment to the plan administrator.

- The goal is to reduce interest rates and fees (when creditors agree), so more of your payment goes to principal.

- A DMP is often a strong fit if you can repay what you owe, but APR + minimum payments make it feel impossible.

- A DMP is not the same as debt settlement—you generally repay full principal: debt settlement vs debt management plan.

- Credit impact varies, but many people see changes because accounts may be closed or restricted while you’re in the plan.

- Choosing the right agency matters: credit counseling how to choose.

What is a debt management plan?

A debt management plan is a repayment program where you:

- enroll eligible unsecured debts into a structured plan,

- make one monthly payment to the agency administering the plan,

- and the agency distributes payments to creditors according to the plan schedule.

The “relief” comes from creditor concessions—often reduced APR and fewer fees—so your payment actually makes progress.

How does a debt management plan work? (step-by-step)

Step 1: Budget review (the reality check)

A counselor reviews your income, expenses, and debts to calculate what you can realistically pay each month without defaulting.

Step 2: Plan proposal (payment + timeline)

You’ll see a proposed:

- monthly payment amount,

- payoff timeline (commonly 36–60 months),

- fees (setup + monthly admin),

- and which accounts can be included.

Step 3: Creditor participation (the hidden “yes/no” factor)

Not every creditor offers the same concessions, and not every account qualifies. A plan works best when the largest balances participate.

Step 4: You make one monthly payment

You pay the plan administrator once per month, and they pay creditors based on the schedule.

Step 5: Accounts are usually closed or restricted

Many DMPs require enrolled credit cards to be closed or frozen to prevent new borrowing. This is a feature, not a bug—it’s how you stop the cycle.

Step 6: You finish with a clear endpoint

If you make all payments, the balances are paid off under the plan terms.

Table: DMP vs hardship vs consolidation vs settlement (quick fit)

| Option | Best for | Typical timeline | Main tradeoff |

|---|---|---|---|

| Creditor hardship program | Temporary setback, you want to stay current | Often months | Short-term relief; not always available |

| DMP (credit counseling) | You can repay principal if APR/fees drop | Often 3–5 years | Accounts may be closed/restricted; fees apply |

| Consolidation loan / balance transfer | You qualify for lower APR and stay disciplined | Loan term / promo period | New credit + risk of running balances back up |

| Debt settlement | Repayment isn’t realistic | Often 24+ months | Higher credit/legal risk; outcomes vary |

Hardship programs

Consolidation comparison

Settlement mechanics

Who a DMP is best for (and who should avoid it)

A DMP is usually a strong fit if you…

- have mostly unsecured debt (credit cards/personal loans),

- are still current or only slightly behind,

- can afford a structured payment if interest drops,

- want a lower-risk plan than settlement,

- need guardrails to stop re-borrowing.

A DMP may be a poor fit if you…

- cannot afford any realistic monthly payment even after concessions,

- need principal reduction to survive,

- have mostly secured debt (auto loan, mortgage) as the main problem,

- are dealing with active legal escalation and need immediate legal guidance.

If you’re deciding between DMP and settlement, compare them here:

debt settlement vs debt management plan.

Does a DMP hurt your credit?

It can affect your credit, but the impact depends on your starting point and how the plan is managed.

Common credit effects people notice

- Accounts may be closed or restricted, which can affect utilization and average account age.

- If you stay on time, your payment history can remain consistent (which matters a lot).

- Over time, reducing balances can improve overall debt metrics.

Practical view: if you’re choosing between a controlled plan with consistent payments and falling behind, a DMP can be the less damaging path for many borrowers—but it’s not invisible.

DMP fees: what you may pay (and what to ask)

Fees vary by agency and state. Don’t sign anything until you can answer these questions clearly.

DMP fee checklist

- What is the setup fee (if any)?

- What is the monthly admin fee?

- Is there a fee per account enrolled?

- What happens if I miss a payment—fees, grace period, plan termination?

- Are expected creditor concessions (APR reductions) listed in writing?

How to vet an agency and avoid traps:

credit counseling how to choose.

DMP vs consolidation loan (when each makes more sense)

When a DMP often makes more sense

- your APRs are high and creditors are willing to reduce them,

- you want structure + guardrails,

- you don’t want to take on a new loan.

When consolidation might make more sense

- your credit/income can qualify you for a truly lower APR,

- the new payment is affordable with room to breathe,

- you’re disciplined enough not to run balances back up.

Full comparison: debt relief vs debt consolidation.

How to start a DMP the right way (so it actually works)

1) Gather your numbers (30 minutes)

- list each debt (balance, APR, minimum payment),

- last 1–2 statements per account,

- your monthly budget and net income.

2) Create your “DMP payment ceiling”

Pick the monthly number you can pay without breaking essentials. If a plan exceeds this, it’s not sustainable.

3) Ask the right questions on the first call

- What’s my payment and timeline?

- Which accounts qualify and which don’t?

- What APR reductions are expected (if any)?

- Are accounts required to be closed/frozen?

- What are all fees and what triggers them?

4) Verify the agency (don’t skip this)

Use the selection checklist: credit counseling how to choose.

5) Commit to “no new debt”

A DMP works when the leaks are sealed. If you keep swiping, no plan survives.

Common mistakes (and red flags)

- Signing up without a written breakdown of total cost + timeline + fees.

- Choosing a plan payment you can’t sustain (it fails, then you’re worse off).

- Treating a DMP like a magic trick instead of a payoff system.

- Ignoring scam signals—pressure tactics, unclear fees, or “guarantees.” Start here:

debt relief scams red flags.

Examples / scenarios

Scenario 1: “I can pay something monthly, but I’m stuck.”

If your cards are current and you can pay a stable amount, but interest keeps you from making progress, a DMP is built for this. It turns “spinning wheels” into a payoff schedule.

Scenario 2: “My minimum payments are barely possible.”

If you can still stay current but minimums consume your budget, a DMP may reduce APR enough that your payment becomes sustainable—before you slide into delinquency.

Scenario 3: “I’m already behind—can a DMP still help?”

Sometimes, but it depends on how far behind you are and whether creditors will participate. If you’re considering settlement instead, compare paths here:

debt settlement vs debt management plan.

And review what delinquency can trigger: stop paying credit cards what happens.

FAQ

What is a DMP in credit counseling?

A DMP is a structured repayment plan administered through credit counseling where you make one monthly payment and (when creditors agree) get reduced APR/fees to pay off balances over a set term.

How long does a debt management plan last?

Many DMPs are designed to finish in about 3–5 years, but the exact term depends on your balances and payment amount.

Can I include all my debts in a DMP?

Not always. DMPs typically focus on unsecured debts like credit cards. Eligibility varies by creditor and account type.

Will a DMP close my credit cards?

Often yes. Many plans require accounts to be closed or frozen so you don’t add new debt while paying off old debt.

Is a DMP better than debt settlement?

If you can repay what you owe with reduced interest and want a predictable plan, a DMP is often better. If you cannot repay 100%, settlement might fit—but it’s higher risk. Compare: debt settlement vs debt management plan.

Is a DMP the same as debt consolidation?

No. Consolidation typically uses a new loan or balance transfer. A DMP is a structured repayment program that may lower interest through creditor concessions. Compare: debt relief vs debt consolidation.

How do I choose a credit counseling agency?

Look for transparency on fees, a real budget review, and clear written terms. Use this checklist: credit counseling how to choose.

Related guides

- Hardship programs (with creditors)

- Avoid debt relief scams