Where to go next

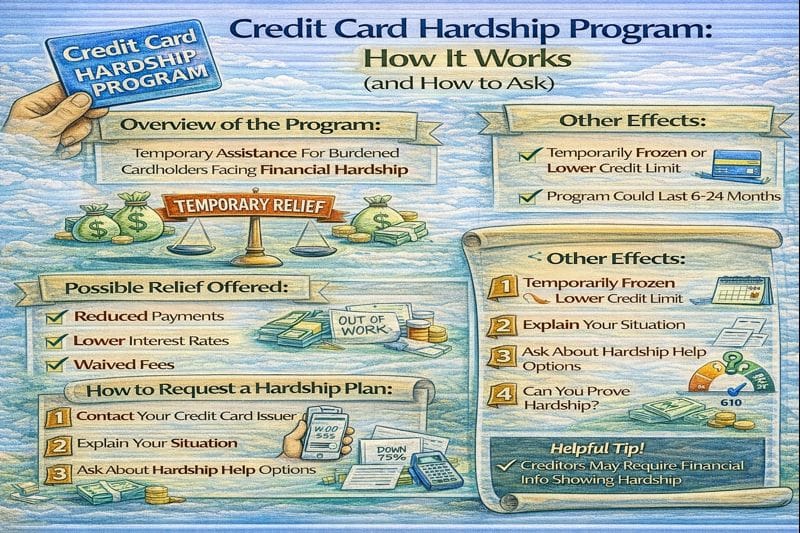

A credit card hardship program is a temporary relief plan offered directly by your card issuer. If you’re dealing with job loss, reduced hours, medical bills, or another short-term hit, a hardship plan may lower your interest rate, reduce your payment, waive fees, or put you on a structured payment plan.

This guide explains what hardship programs typically include, how to ask for one, what to say on the phone, and what to do if your creditor says no.

Quick answer / Key takeaways

- A hardship program is directly with the creditor (no third party required).

- The goal is usually temporary affordability: lower APR, lower payment, waived fees, or a payment plan.

- Terms vary by creditor; hardship plans are often months-long, not years-long.

- Asking early (before you fall behind) improves your odds.

- If you need multi-year structure, a DMP may fit better: debt management plan dmp.

- If you’re already behind and considering stopping payments, read this first: stop paying credit cards what happens.

What is a credit card hardship program?

A hardship program (sometimes called a hardship plan or temporary assistance program) is a creditor’s internal option to help you keep paying during a temporary financial setback. It’s not standardized and it’s not guaranteed—but it can be one of the fastest ways to get relief without enrolling in a third-party program.

Common types of hardship help

- Reduced APR (temporary or longer-term)

- Lower minimum payment (temporary)

- Waived late fees or reduced penalty APR

- A fixed payment plan (sometimes with closed/frozen charging privileges)

- Short deferment/forbearance (less common for credit cards)

Who hardship programs are best for

Best fit when

- your setback is temporary (you expect income to recover),

- you want to avoid delinquency and keep things contained,

- you can make some payment if terms improve.

Usually not enough when

- your budget can’t support any realistic payment long-term,

- you need a structured multi-year payoff plan,

- you’re already far behind and collectors are involved.

If you need long-term structure: debt management plan dmp.

If you’re comparing DMP vs settlement: debt settlement vs debt management plan.

Hardship plan vs settlement (what’s the difference?)

Hardship is a keep-paying strategy. Settlement is a pay-less strategy.

- Hardship plan: you’re asking the creditor for temporary help so you can keep paying.

- Debt settlement: you’re negotiating to pay less than you owe, often after delinquency, with higher credit and legal risk.

Settlement mechanics: debt settlement how it works.

If you’re considering skipping payments: stop paying credit cards what happens.

Table: Hardship vs DMP vs settlement (quick comparison)

| Option | Who it’s best for | Typical timeline | Credit / legal risk | What you’re really getting |

|---|---|---|---|---|

| Hardship program (with creditor) | Temporary setback, you want to stay current | Often months | Usually lower risk | Lower APR/payment or a short payment plan |

| DMP (credit counseling) | You can repay principal but need structure | Often 3–5 years | Usually moderate | One structured plan, often lower rates |

| Debt settlement | You can’t repay in full | Often 24+ months | Higher risk | Potential principal reduction (not guaranteed) |

Payment plan with creditor: what to ask for (the exact menu)

When you call, ask what options exist for your account. Use this checklist:

The “ask” checklist

- Can you reduce my interest rate for a hardship plan? For how long?

- Can you waive late fees or reverse a recent fee as part of hardship?

- Can you lower my minimum payment temporarily?

- Do you offer a fixed payment plan (set payment for X months)?

- Will the account be closed or frozen while on the plan?

- Will my account be reported as current if I make hardship payments on time?

- What happens if I miss one payment—does the plan end immediately?

How to ask for a credit card hardship program (script + steps)

Step 1: Call the right department

Ask for: “hardship assistance,” “financial assistance,” or “payment assistance.”

Have your account number ready.

Step 2: Lead with the reason (short and factual)

Use simple language: job loss, reduced hours, medical expenses, temporary hardship. Keep it clean. You’re not on trial—you’re requesting terms.

Step 3: Make the request (specific options)

Example script:

“I want to keep paying and avoid falling behind. Do you have a hardship plan that can lower my interest rate or set a fixed payment for a few months?”

Step 4: Negotiate the terms (don’t accept vague)

Confirm:

- APR, payment amount, and duration,

- whether fees are waived,

- whether the account will be frozen/closed,

- whether you’ll be considered current if you pay as agreed.

Step 5: Get it in writing (or at least documented)

Ask for written confirmation by email/secure message if available. If not, ask the rep to read back the terms and confirm the notes are added to your account.

Reduce interest rate hardship: what’s realistic?

Creditors don’t publish a standard offer, but these points are consistent:

- If you’re paying a high APR, even a moderate reduction can materially change payoff speed.

- Many hardship plans are temporary; you may need to re-evaluate before the plan ends.

If you need a longer-term solution, a DMP is built for multi-year payoff structure:

debt management plan dmp.

What if your creditor says “no”?

Don’t stop at one answer. Use this escalation path.

Option 1: Ask for a different program type

If they won’t reduce APR, ask about:

- fixed payment plans,

- fee waivers,

- payment due date changes.

Option 2: Ask what triggers eligibility

Some creditors won’t offer relief until you’re close to delinquency. Ask what would make you eligible and what documentation they need.

Option 3: Compare alternatives

- If you can repay principal but need structure: debt management plan dmp.

- If you can qualify for better terms: debt relief vs debt consolidation.

- If you’re headed toward delinquency and need the timeline: stop paying credit cards what happens.

Common mistakes (and red flags)

- Waiting until you’re deep delinquent before asking.

- Accepting terms you don’t understand (APR, duration, reporting).

- Using hardship relief as an excuse to keep spending on the card.

- Not asking whether the account will be frozen/closed.

- Assuming hardship is a permanent fix (it’s usually a bridge, not a destination).

Examples / scenarios (If X → do Y)

Scenario 1: Temporary income drop, you want to stay current

If you expect income to recover in the next few months, start with a hardship request. It’s the fastest direct option.

Scenario 2: Interest is the issue, not the balance

If you can repay principal but APR makes it impossible, you may be better served by a multi-year plan like a DMP:

debt management plan dmp.

Scenario 3: You’re already behind and creditors aren’t cooperating

If you’re delinquent and hardship options are limited, understand the escalation path and higher-risk options:

stop paying credit cards what happens.

FAQ

How do I ask for a hardship program on a credit card?

Call and ask for hardship/financial assistance. State your hardship briefly and request specific options (lower APR, fee waiver, or fixed payment plan). Get terms documented.

Will a hardship program hurt my credit?

It depends on how the creditor reports the account and whether you stay current. Ask directly if you’ll be reported as current when paying under the plan.

Is a hardship plan the same as a payment plan?

A hardship plan may include a payment plan, but it can also include APR reduction or fee relief. Ask what programs your issuer offers.

How long do hardship programs last?

Often a few months, sometimes longer. The duration varies by creditor and the program type.

Should I choose a hardship plan or a DMP?

If your problem is temporary, start with hardship. If you need a multi-year structured payoff plan, a DMP may fit better:

debt management plan dmp.

Hardship plan vs settlement: which is better?

Hardship is lower risk and aims to keep you paying. Settlement aims to reduce what you pay back but usually carries higher credit and legal risk.