Where to go next

Credit counseling can be a real, practical way to get control of credit card debt—especially if a Debt Management Plan (DMP) would lower your interest rates and give you one structured payment. But the space is noisy: some “counselors” are basically sales funnels.

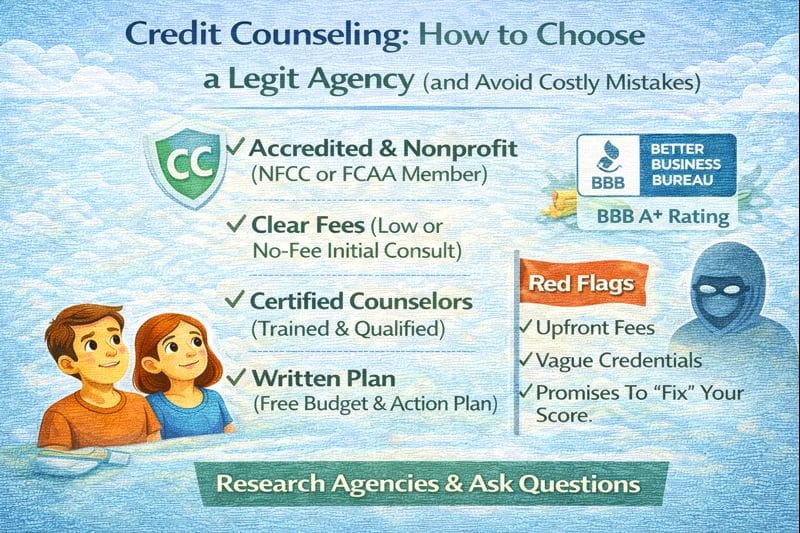

This guide shows you how to choose a credit counseling agency the smart way: what to ask, what fees are normal, what red flags mean “walk,” and when you should be looking at a different option instead.

Quick answer / Key takeaways

- A legit credit counseling agency starts with a budget review—not a pitch for one product.

- Many agencies offer an initial counseling session for free (fees may apply if you enroll in a DMP).

- Typical DMP fees are often around ~$75 or less setup and ~$25–$50 monthly (varies by state/agency).

- If someone pushes you into debt settlement without explaining consequences (fees, collections, lawsuits), that’s not counseling—it’s selling.

- Use proof checks (written fee schedule, counselor credentials, complaint patterns) before you share sensitive info.

- DMP basics (so you know what you’re being offered): debt management plan dmp.

What is credit counseling (and what it is not)?

Credit counseling is a service that helps you:

- understand your full debt picture,

- build a budget and plan,

- compare options (DIY payoff, hardship plans, consolidation, DMP, settlement),

- and, if appropriate, enroll in a Debt Management Plan.

Credit counseling is not automatically a DMP. A good agency will explain your options even if you don’t enroll.

Is credit counseling legit?

It can be. The legit version has three traits:

- Education first: budget + options review.

- Transparency: fees and terms are clear before you sign.

- No pressure: you’re not rushed into a program on the first call.

If you’re searching “is credit counseling legit,” what you really want is a filter that separates:

- real nonprofit-style counseling and DMP administration, from

- lead-gen funnels that route you into higher-risk products.

Use the checklist below and you’ll know which is which.

Credit counseling fees (what’s normal and what’s not)

Fees vary by state and agency, but here’s the practical framework.

Common legit fee structure (if you enroll in a DMP)

- Initial counseling session: often free

- Setup fee: commonly a one-time fee

- Monthly admin fee: ongoing while you’re in the plan

What to ask for (non-negotiable)

- A written fee schedule (setup + monthly + any per-account fees)

- Whether fee waivers exist if income is low

- Exactly what triggers extra fees (missed payments, changes, etc.)

If they won’t clearly explain fees in writing before you commit, treat that as a red flag.

Nonprofit credit counseling vs debt settlement (not the same)

Quick reality check:

- Credit counseling/DMP: usually aims for full repayment of principal with lower interest and structure.

- Debt settlement: aims to pay less than owed, often after delinquency, with higher credit damage and higher collection risk.

Settlement mechanics: debt settlement how it works.

Direct comparison: debt settlement vs debt management plan.

Credit counseling (DMP) vs debt settlement (table)

| Category | Credit counseling / DMP | Debt settlement |

|---|---|---|

| Goal | Make repayment affordable (often full principal) | Reduce total paid (less than owed) |

| Best for | You can repay if APR/fees drop | You can’t repay 100% and need reduction |

| Timeline | Often 3–5 years | Often 24+ months (varies) |

| Payment pattern | One structured monthly payment | Often “save funds, settle later” |

| Credit impact (typical) | Moderate; accounts may be closed/restricted | Often heavier due to delinquency/collections |

| Risk level | Lower if you stay current | Higher collections/lawsuit risk |

| Fee logic | Setup + monthly admin fee | Fee model varies; scam risk is higher |

| Tax angle | Usually none from forgiveness | Possible tax issues if debt is forgiven: debt settlement taxes 1099c |

How to choose a credit counseling agency (step-by-step)

Step 1) Do a “fit check” before you pick an agency

Credit counseling/DMP tends to fit best when:

- your debt is mostly unsecured (credit cards, personal loans),

- you still have income and can afford a structured payment,

- your main problem is high APRs and chaos—not total inability to pay.

If you cannot afford minimum payments at all, understand the delinquency path first:

stop paying credit cards what happens.

Step 2) Shortlist 2–3 agencies (don’t marry the first one)

A quick shortlist method:

- Look for agencies that clearly offer budget counseling + education, not only “enrollment.”

- Bonus signal: they can provide required counseling for bankruptcy-related education (verification layer, not perfection).

Step 3) Interview them (10 minutes, same questions every time)

Ask these and compare answers.

Core questions

- What services do you offer besides a DMP?

- Is the first counseling session free? If not, what does it cost?

- What are all fees (setup, monthly, per-account), and can I get them in writing?

- Are counselors certified, and how are they trained?

- How are counselors compensated—salary or commission?

- Will enrolled credit card accounts be closed or frozen?

- What happens if I miss a payment?

- Do you have a sample contract I can read before enrolling?

Step 4) Verify before you sign (5-minute proof checks)

- Can you find clear contact info, physical address, and real policies?

- Do they provide a written contract and cancellation terms?

- Do they have complaint patterns that match “pressure + confusion”?

If you want the scam filter in one place:

debt relief scams red flags.

Red flags (walk away fast)

Sales behavior red flags

- They push a DMP before reviewing your budget and debts.

- They refuse to send fees and terms in writing.

- They pressure you to “enroll today” to lock a deal.

- They discourage you from comparing options.

Product red flags (especially if they steer you to settlement)

- They tell you to stop paying creditors without explaining consequences.

- They promise a guaranteed outcome or “we can’t fail.”

- They blur the line between counseling and settlement.

If you’re being pushed toward settlement, read the risk reality first:

credit card lawsuit garnishment.

How to prepare for a credit counseling session (so it’s useful)

What to gather (30 minutes)

- Last 1–2 statements for each credit card / loan

- Balance, APR, and minimum payment for each account

- Your monthly income and essential expenses

- Your status (current / 30 / 60 / 90+ days late)

What you should leave the call with

- A written summary of options discussed

- A proposed DMP payment (if recommended) with timeline

- A complete fee schedule

- Clear next steps (even if you don’t enroll)

Examples / scenarios (real decisions)

Scenario 1: “I can pay something monthly, but APR is killing me.”

If you’re current and the main issue is high interest, credit counseling + a DMP review makes sense.

Read DMP basics before you enroll: debt management plan dmp.

Scenario 2: “They immediately pushed me into settlement.”

If the “counselor” skipped budgeting and went straight to settlement, treat it as a sales funnel.

Compare paths: debt settlement vs debt management plan.

Scenario 3: “My payments are impossible right now.”

If you’re choosing between essentials and minimum payments, understand what delinquency can trigger and what options exist:

stop paying credit cards what happens.

FAQ

How do I choose a credit counseling agency?

Shortlist 2–3, interview them with the same questions, demand written fees/terms, and avoid any agency that pushes a single product without a budget review.

What are typical credit counseling fees?

Many agencies offer free initial counseling. If you enroll in a DMP, fees commonly include a setup fee and a monthly admin fee (exact numbers vary by state and agency).

Is nonprofit credit counseling better than debt settlement?

They solve different problems. Nonprofit-style counseling/DMP is usually better if you can repay with lower interest and want predictable payments. Settlement may fit only if full repayment isn’t realistic and you accept higher risk.

Can credit counseling hurt your credit?

Counseling itself doesn’t “hit” your score, but a DMP may involve closing or restricting accounts, which can affect utilization and account history. The upside is a structured plan that can prevent delinquency.

Should I pay upfront fees for debt relief?

Be careful with anyone mixing “counseling” and “settlement.” Settlement has higher scam risk and the fee rules differ depending on what’s being sold. If anything feels rushed or unclear, don’t sign—verify and compare.

Scam checklist: debt relief scams red flags.

Related guides

- Hardship programs (with creditors)

- Debt relief vs consolidation

- Debt relief options (explained)