Where to go next

In most credit card debt cases, wage garnishment usually happens after a lawsuit and after a court judgment. That’s the normal path.

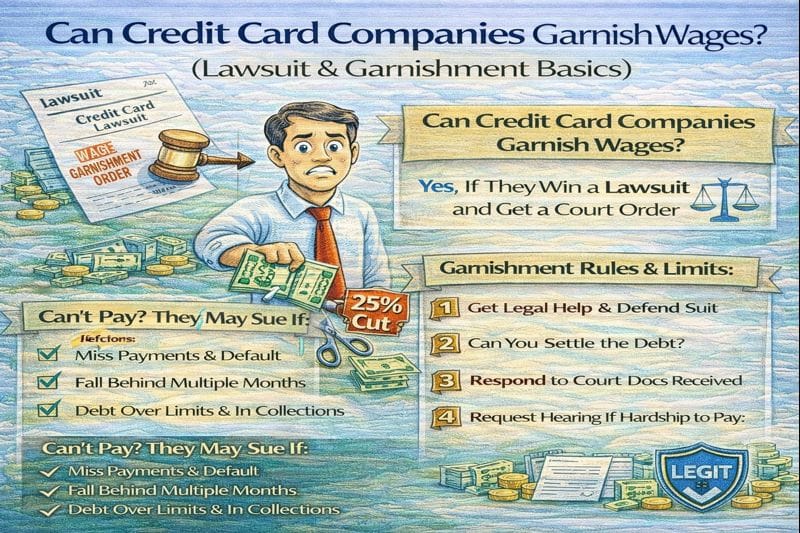

This guide explains the typical lawsuit timeline, whether collectors can garnish without court, what garnishment limits generally look like, and what to do if you get served.

Quick answer / Key takeaways

- Wage garnishment for credit card debt usually requires a court judgment first.

- Collectors typically can’t garnish wages “instantly” for credit cards without going through court.

- Ignoring a summons is the fastest way to lose control (default judgment risk).

- Garnishment limits depend on federal/state rules; many cases follow a general cap tied to disposable earnings.

- If you’re not sued yet, acting early can reduce escalation: creditor hardship programs.

Can collectors garnish wages without court?

For typical consumer credit card debt, wage garnishment is generally a post-judgment tool. That means a creditor or collector usually needs to:

- sue you, and

- win a judgment.

If someone threatens “we’ll garnish you tomorrow” for a credit card balance, treat it as a credibility test. Verify everything before you pay.

How wage garnishment happens (plain-English flow)

- You fall behind and collections start.

- A lawsuit may be filed (you get served papers).

- A judgment is entered (often by default if you don’t respond).

- Enforcement tools become possible, including wage garnishment (rules vary by state).

If you’re earlier in the timeline and want the escalation map, start here:

stop paying credit cards what happens.

Credit card lawsuit timeline (typical stages)

Stage 1: You’re served (summons + complaint)

This is official. It usually includes:

- who is suing you,

- the amount claimed,

- and how to respond.

What to do

- Note the response deadline immediately.

- Save the envelope and all pages.

- Don’t call it “just a threat” if it’s real court paperwork.

Stage 2: Response window

If you miss the deadline, the plaintiff may request a default judgment.

What to do

- Respond on time (even if you plan to negotiate).

- Keep proof of filing/delivery.

Stage 3: Judgment (contested or default)

If a judgment is entered, the plaintiff may be able to use enforcement tools allowed in your state.

What to do

- Don’t panic. Get organized, review options, and communicate in writing when possible.

Stage 4: Enforcement (possible wage garnishment)

If wage garnishment is pursued, your employer receives an order and withholds wages as required.

What to do

- Confirm the order is legitimate.

- Confirm the withholding amount follows applicable limits.

- If you’re overwhelmed, consider professional help appropriate to your situation.

How much can they garnish? (general limits)

Garnishment rules vary by state, but many people fall under a general framework where only a portion of disposable earnings can be taken, with protections to prevent leaving you with nothing.

If you’re facing a real garnishment notice, the exact limits should be checked for your state and the type of debt involved.

Lawsuit → garnishment: what happens and what you do (table)

| Stage | What typically happens | Your best move |

|---|---|---|

| Behind on payments | Calls/letters, fees, escalation | Try hardship options early: creditor hardship programs |

| Served with summons | You’re officially sued | Track the response deadline; save documents; don’t ignore |

| No response | Default judgment risk increases fast | File a response on time; keep proof |

| Judgment entered | Enforcement tools become possible | Choose a realistic plan; avoid pressure tactics/scams |

| Garnishment begins | Employer withholds wages | Confirm legitimacy + limits; get help if needed |

What to do if you’re sued for credit card debt (checklist)

1) Verify it’s real

Make sure it’s actual court paperwork, not a “scare letter.” Real paperwork typically includes a court name, case number, and filing details.

2) Don’t miss the deadline

Even if you owe the debt, missing the response deadline can put you on the default-judgment track.

3) Get your documents together

- account statements and last known balance

- any settlement letters or payment history

- who owns the debt (original creditor vs debt buyer)

- your current income and basic budget

4) Pick a plan that matches reality

- Temporary setback? Start with hardship: creditor hardship programs.

- Can repay principal but need structure? DMP: debt management plan dmp.

- Can’t repay in full and considering settlement? Understand the process first: debt settlement.

5) Don’t rely on “phone promises”

If you negotiate, get terms in writing.

Red flags (common pressure tactics)

- “Pay today or you’ll be arrested.”

- “We’re garnishing you tomorrow.”

- Refusing to provide case details.

- Pushing unusual payment methods or refusing written confirmation.

If you’re seeing multiple red flags, read the scam checklist:

debt relief scams red flags.

Examples / scenarios

Scenario 1: You’re behind but not sued yet

If you still have time, your best move is prevention: ask your creditor for hardship options before things escalate.

creditor hardship programs.

Scenario 2: You got served and you’re panicking

First goal is control: respond on time and get organized. Then choose a realistic path (DMP vs settlement) based on your budget.

Comparison: debt settlement vs debt management plan.

Scenario 3: Someone claims they can garnish without court

Treat it as a verification moment. Ask for court details and case number. If it’s not real, don’t pay under pressure.

FAQ

Can credit card companies garnish wages?

Usually only after they sue you and get a court judgment.

Can collectors garnish wages without court?

For typical consumer debts like credit cards, generally no. Some government debts can use administrative garnishment rules.

How long does a credit card lawsuit take?

It varies by state and court. The key point: deadlines to respond can be short, and ignoring papers can lead to default judgment.

What should I do if I’m sued for credit card debt?

Verify it’s real, track the response deadline, file a response, and then decide on a realistic plan (hardship/DMP/settlement).

How much of my paycheck can be garnished?

It depends on federal/state limits and the type of debt. Many cases follow a general cap tied to disposable earnings, with protections.