Where to go next

Late payments are one of the most damaging items on a credit report because they hit the “did you pay on time?” question directly. The hard truth: accurate late payments usually stay, but you still have a few realistic paths—especially if the late mark is wrong, or if you have a strong history and a one-time mistake.

This guide covers the real options: disputes (for true errors), goodwill letters, what “pay for delete” means (rare for late payments), how long late payments stay, and what to do if removal isn’t realistic.

Quick answer / Key takeaways

- If the late payment is inaccurate, dispute it with proof (best path): how to dispute credit report errors.

- If it’s accurate, your main “removal” tool is often a goodwill letter (works sometimes, not guaranteed).

- “Pay for delete” is mostly discussed for collections; for late payments it’s rare because the lender is reporting its own history.

- Late payments can remain on reports for years; impact usually fades over time if you build new positives.

- Your fastest improvement lever while you wait is often utilization + perfect on-time history: credit utilization.

First: is the late payment real or an error?

You only have two categories:

Category A: The late mark is wrong (dispute-worthy)

Examples:

- you paid on time but it posted late,

- the account isn’t yours,

- the date/status is wrong,

- duplicate late marks.

Start with: how to check credit reports.

Then file a clean dispute: how to dispute credit report errors.

Category B: The late mark is accurate

Then it’s not about “winning a dispute.” It’s about:

- goodwill requests,

- rebuilding strategy,

- and avoiding anything that adds new negatives.

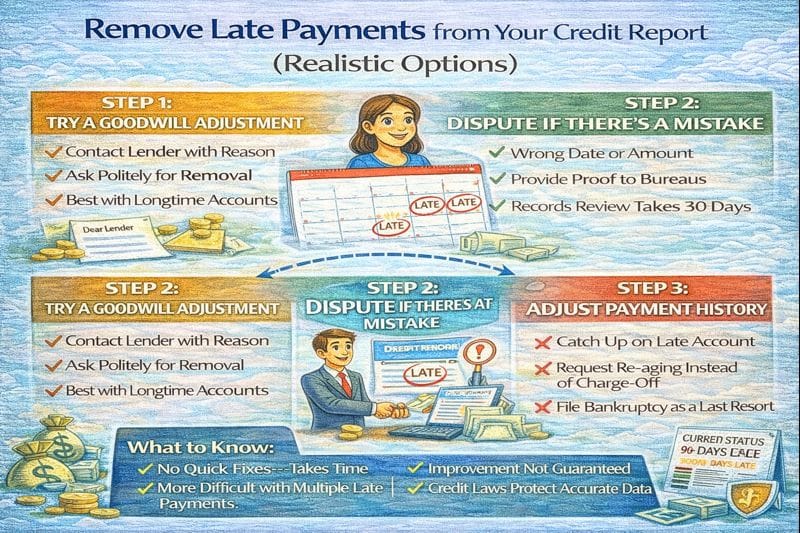

How to remove late payments from credit report (your realistic options)

Option 1: Dispute inaccurate late payments (best-case)

If you can prove the late mark is inaccurate, dispute it with:

- statements showing the due date and payment received date,

- bank records, confirmations, screenshots,

- any creditor messages that support your case.

Step-by-step process: how to dispute credit report errors.

Timeline and “verified” meaning: credit dispute timeline.

Option 2: Goodwill letter late payment (most common “maybe”)

A goodwill letter is a request—not a demand. You’re asking the lender to remove a one-time late mark as a courtesy.

Goodwill works best when:

- you have a strong prior on-time history,

- the lateness was isolated (one 30-day),

- you’re currently paid up and stable,

- your reason is factual and short (not dramatic).

Goodwill tends to fail when:

- you have repeated late payments,

- the account is currently delinquent,

- you’re asking without any credibility (no history).

Option 3: “Pay for delete” late payment (rare and usually misunderstood)

People search this because they want: “If I pay, will they delete the late mark?”

For late payments, it’s uncommon because:

- the lender is reporting its own payment history,

- deleting accurate history can conflict with reporting consistency.

If you’re dealing with collections, pay-for-delete is more often discussed there:

collections on credit report.

Option 4: If removal isn’t realistic, rebuild around it

If the late mark is accurate and goodwill fails, the play becomes:

- prevent new lates (autopay minimums),

- keep utilization low,

- build positive months on top of the negative.

Fast wins: credit utilization.

Score update timing: how often credit scores update.

Goodwill letter template (copy + edit)

Use this when the late payment is accurate but you want a goodwill adjustment.

Subject: Goodwill Request — Late Payment Adjustment

Hello,

I’m writing to request a goodwill adjustment for a late payment on my account [Account Name / Last 4 digits] reported for [Month/Year].

I understand I was late and I take responsibility. This was an isolated issue caused by [brief factual reason—job change, mail delay, autopay issue, temporary hardship], and my account has otherwise been in good standing.

I value my relationship with [Creditor Name] and I’m requesting, as a one-time courtesy, that you consider removing the late payment notation for [Month/Year] from my credit reports.

Thank you for your time and consideration,

[Your Name]

[Phone / Email optional]

Table: Late payment removal options (what works and when)

| Situation | Best option | What you need | Realistic outcome |

|---|---|---|---|

| Late mark is inaccurate | Dispute | Proof documents | Correction or deletion possible |

| One-time 30-day late, good history | Goodwill letter | Short request + good standing | Sometimes removed |

| Multiple lates / ongoing delinquency | Stabilize first | Bring account current + autopay | Removal unlikely; rebuild needed |

| Late + collections mixed in | Separate issues | Report review + targeted actions | Depends on accuracy and strategy |

Step-by-step: what to do this week

- Pull all three credit reports and confirm exactly which bureau(s) show the late mark:

how to check credit reports. - Identify whether it’s inaccurate or accurate (don’t guess).

- If inaccurate: dispute with proof:

how to dispute credit report errors. - If accurate: send a goodwill request (short, factual, one-time).

- Regardless: lock in prevention

- autopay at least the minimum,

- calendar reminders,

- keep utilization controlled: credit utilization.

How long does a late payment stay on your credit report?

Late payments can stay on credit reports for years. The good news: the impact often fades as:

- more on-time payments stack up,

- balances drop,

- no new negatives appear.

If you need “how often scores update” timing:

how often credit scores update.

Common mistakes (that waste time or make it worse)

- Disputing accurate late payments without proof (usually gets “verified”).

- Sending a long emotional story instead of a clean request.

- Applying for new credit repeatedly while trying to recover.

- Paying after statement close and keeping utilization high (score stays depressed).

- Falling for “guaranteed deletion” services.

Examples / scenarios (If X → do Y)

Scenario 1: “I’m sure I paid on time.”

Pull statements and bank proof and dispute the exact month/status.

How to dispute credit report errors.

Scenario 2: “I missed one payment during a rough month.”

If the account is current now and you have a good history, send a goodwill letter and keep it short.

Scenario 3: “I have several late payments.”

Don’t chase deletion as the main plan. Stabilize: autopay minimums, reduce utilization, stop new inquiries, and build clean months.

Credit utilization.

FAQ

Can I remove late payments from my credit report?

If the late payment is inaccurate, yes—disputes can correct it. If it’s accurate, removal is not guaranteed, but goodwill requests sometimes work for isolated mistakes.

Do goodwill letters work for late payments?

Sometimes—especially for a one-time 30-day late with an otherwise strong history. It’s not guaranteed.

Can I do “pay for delete” for a late payment?

It’s rare for late payments because lenders are reporting their own payment history. Pay-for-delete is more commonly discussed with collections.

Collections on credit report.

How long do late payments stay on credit reports?

Late payments can stay for years, but their impact often fades as you build new positive history.

What’s the fastest way to improve my score while a late payment remains?

Keep utilization low and avoid new negatives.

Credit utilization.