Where to go next

Most people treat their credit score like a mysterious “grade.” It’s not. It’s a risk score based on what’s in your credit reports—and you can check it without damaging it in most cases.

This guide explains how to check your credit score for free, what “soft inquiry” means, when checking can hurt (rare but real), and what to track so the number actually helps you.

Quick answer / Key takeaways

- Checking your own credit score is usually a soft inquiry and does not hurt your credit.

- A hard inquiry happens when you apply for new credit (cards, loans) and can cause a short-term dip.

- You can have multiple scores (FICO vs VantageScore, and different bureaus), so always note the model + bureau.

- If your score changes, it’s usually because of utilization, reporting timing, new inquiries/accounts, or new negative items.

- If you haven’t checked your reports recently, start there first: how to check credit reports.

Can you check your credit score for free without hurting your credit?

Yes—most of the time.

The simple rule

- Soft inquiry: you checking your own score, account monitoring, many pre-approvals → no score damage.

- Hard inquiry: you applying for credit (or a lender pulling for a real decision) → may lower score briefly.

If you’re unsure why you have multiple scores, read: fico vs vantagescore.

Soft inquiry vs hard inquiry (what it actually means)

Soft inquiry (safe)

A soft inquiry is a check that is not tied to a new credit application decision. It’s typically invisible to lenders and doesn’t affect your score.

Hard inquiry (can affect score)

A hard inquiry is tied to an application for new credit. It can cause a small, usually temporary score drop.

Full breakdown: hard inquiries.

Where your credit score comes from

Your score is calculated from your credit report data (accounts, balances, payment history, inquiries). That’s why two things matter:

- your reports (the underlying data), and

- the scoring model (how that data is scored).

Check your reports here: how to check credit reports.

Score basics here: what is a credit score.

Which credit score are you seeing?

This is where people get tricked by “one number.”

1) FICO vs VantageScore

Many consumer apps show a VantageScore, while many lenders use a FICO model.

Fico vs vantagescore.

2) Bureau matters

You can have different scores from Experian, Equifax, and TransUnion because the report data differs.

3) Version matters

Even within FICO, there are versions. That’s why the “right” score depends on your goal (mortgage, auto, card).

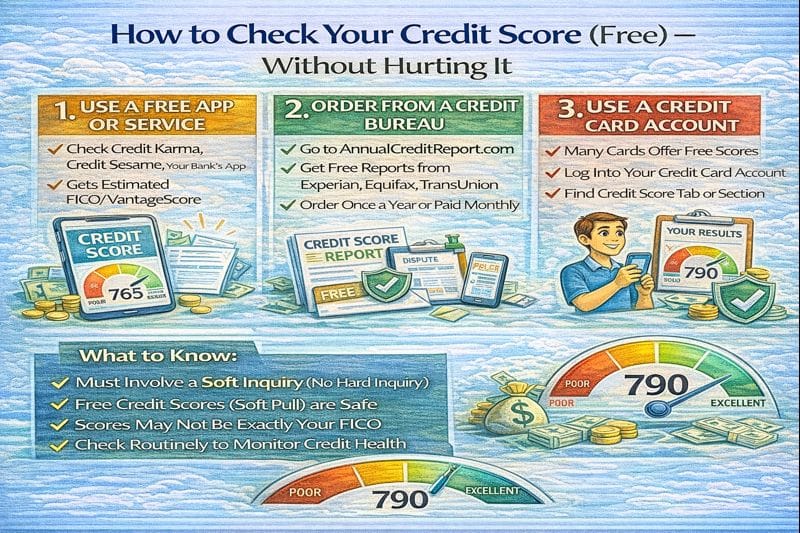

How to check your credit score (step-by-step)

Step 1: Decide what you’re checking for

- Monitoring / rebuilding: trend tracking is fine.

- Applying soon: you want the most relevant model/bureau you can access.

Step 2: Check your score through a source that labels the model

When possible, use a source that clearly shows:

- the scoring model (FICO or VantageScore),

- the bureau,

- the date.

If it doesn’t show model + bureau, it’s harder to interpret.

Step 3: Save a baseline snapshot

Write down:

- score, model, bureau, date,

- your reported utilization (if shown),

- any recent inquiries or late marks you know about.

Step 4: If the score looks “off,” verify the reports

A score is only as good as the report data behind it.

How to check credit reports.

Table: Common ways people check scores (and whether it hurts)

| Method | What it usually is | Can it hurt? | Best use |

|---|---|---|---|

| Checking your own score (monitoring) | Soft inquiry | No | Track trends, watch for changes |

| Pre-qualification / pre-approval | Usually soft | Usually no | Shopping without committing |

| Applying for a credit card/loan | Hard inquiry | Yes (often small/temporary) | Only when you’re ready |

| Employer/background-related checks | Often soft or non-score | Usually no | Verification, not lending |

When checking can hurt (rare but real)

- If you click through an offer and accidentally submit a full application.

- If you “rate shop” incorrectly by applying repeatedly across products without understanding inquiry handling.

- If you authorize a hard pull for a decision (that’s the point of applying).

If you’re about to shop rates, learn inquiry rules here: hard inquiries.

How often should you check your credit score?

A realistic approach:

- If you’re rebuilding: monthly is enough for most people.

- If you’re applying soon: check more frequently, but focus on the inputs (utilization, inquiries, errors) not the dopamine of the number.

To understand when scores update: how often credit scores update.

What to do if your score drops

Don’t guess—use a simple filter:

1) Check utilization first

A higher reported balance is one of the most common reasons for a quick drop.

Credit utilization.

2) Check for a new inquiry or new account

3) Check for new negative items or errors

Dispute real errors: how to dispute credit report errors.

Examples / scenarios

Scenario 1: “I checked my score and it dropped 20 points.”

The check itself likely didn’t cause it. Something changed on your report (utilization, inquiry, new account, or a negative). Start with utilization and report review.

Credit utilization.

How to check credit reports.

Scenario 2: “I’m about to apply for a car loan—what should I do first?”

Keep utilization low, avoid new hard inquiries, and verify your reports for errors.

How to check credit reports.

Hard inquiries.

Scenario 3: “My bank shows one score and an app shows another.”

That’s usually model/bureau differences (FICO vs VantageScore).

Fico vs vantagescore.

FAQ

How can I check my credit score for free?

Many services provide free access to a score. What matters is that you know which model (FICO/VantageScore) and bureau it uses.

Does checking your credit score hurt your credit?

Usually no—most consumer score checks are soft inquiries.

What’s the difference between a soft and hard inquiry?

Soft inquiries are for monitoring or pre-qualification and don’t affect your score. Hard inquiries are tied to applications and can cause a short-term score drop.

Hard inquiries.

Why do I have different credit scores?

Different scoring models (FICO vs VantageScore), different bureaus, and different timing can all cause score differences.

Fico vs vantagescore.

How often should I check my credit score?

Monthly is enough for most people rebuilding credit. If applying soon, watch utilization and report accuracy more than the score itself.