Where to go next

Your credit report is the source file behind every credit score. If you only watch the number, you’ll miss the real problems: wrong late payments, accounts you don’t recognize, outdated balances, or collections that should be handled differently.

This guide shows how to get your credit reports, how to check all 3 bureaus, how often to check, and what to review so you actually catch issues that matter.

Quick answer / Key takeaways

- You have three credit reports (Experian, Equifax, TransUnion). They can differ.

- You can check your reports for free through the official free-report process and through some bureau tools; what matters is getting all three.

- Checking your credit report does not hurt your credit (it’s not a hard inquiry).

- Check before big moves (renting, mortgage, auto, new cards) and whenever something feels off.

- If you find errors, use a clean dispute process: how to dispute credit report errors.

What a credit report is (in plain English)

A credit report is your credit history file: accounts, balances, payment history, inquiries, and public-record style items (when applicable). Credit scores (FICO/VantageScore) are calculated from this data.

Start with score basics if you need it: what is a credit score.

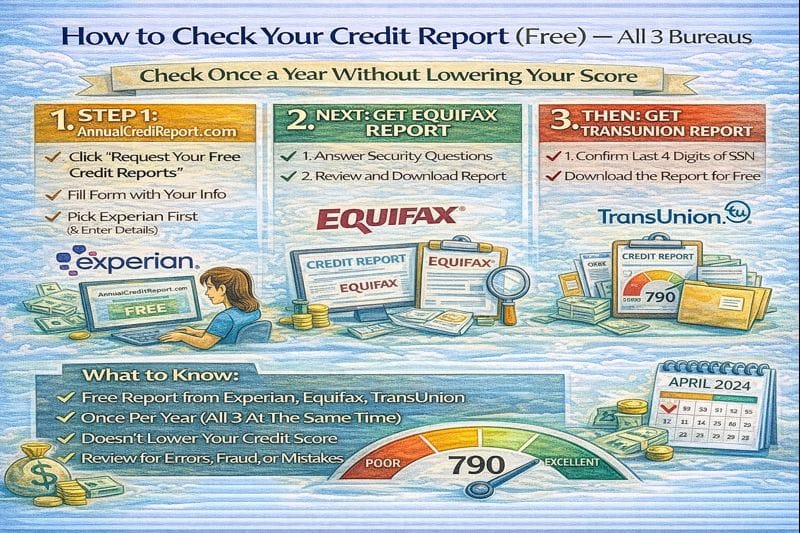

How to get free credit reports (the practical options)

You want full reports (not just a score) and you want all 3 bureaus.

Option 1: Pull your free reports for all three bureaus

This is the “baseline” move: pull each bureau’s report and save copies (PDF if possible). It’s the cleanest way to compare what’s actually being reported.

Option 2: Use a bureau account to monitor changes

Many people also create bureau accounts to monitor updates, but don’t treat monitoring as a replacement for pulling the full reports when you need details.

Option 3: If you’re about to apply for major credit

Before a mortgage/auto/lease, get your reports and review for errors and high-impact items. Don’t wait until after a denial.

If you also want to track your score without hurting credit: how to check credit score.

Check all 3 bureaus (this is where people get it wrong)

A lot of people check one report and assume they’re “good.” Mistake. Differences happen because:

- one bureau has an account the others don’t,

- balances report at different times,

- a collection shows on one report but not the others,

- identity mistakes hit one bureau first.

Rule: if it matters, check all three.

What to look for on your credit report (high-impact checklist)

1) Personal info that doesn’t match you

Wrong name variations, addresses you never used, wrong employer can signal mixed files or fraud.

If anything looks like identity theft: identity theft first steps.

2) Accounts you don’t recognize

Look for:

- accounts you never opened,

- duplicate accounts,

- accounts showing as open that should be closed.

3) Late payments and delinquencies

Late marks are among the highest impact negatives. If a late mark is wrong, that’s dispute-worthy.

Late payment options: remove late payments.

4) Collections

Collections rules vary (especially medical). Don’t panic—get the facts first:

collections on credit report.

5) Credit utilization clues (reported balances)

Your utilization is based on reported statement balances, not just what you carry after you pay.

Fast wins: credit utilization.

Reporting timing: how often credit scores update.

6) Hard inquiries you don’t recognize

Some inquiries are normal. Unknown ones may be fraud or errors.

Hard inquiries explained: hard inquiries.

Table: What to check (and what to do if it’s wrong)

| Section | What to scan for | If you find an issue |

|---|---|---|

| Personal info | Wrong names, addresses, employers | Treat as possible mix-up/fraud; document it |

| Accounts | Accounts you don’t recognize, duplicates | Verify first; escalate to ID theft steps if needed |

| Payment history | Late marks, charge-offs | Dispute only inaccurate items; keep proof |

| Collections | Old/duplicate/incorrect collections | Confirm ownership and accuracy before action |

| Inquiries | Hard pulls you didn’t authorize | Investigate; dispute if truly unauthorized |

| Balances | High reported statement balances | Use utilization timing tactics |

How often should you check your credit report?

There’s no magic number, but here’s a realistic schedule.

Check your reports…

- Before major applications (mortgage, auto, rental).

- After big changes (paid off a card, settled a debt, removed a collection).

- If you suspect identity theft or see a weird score drop.

- Every few months if you’re actively rebuilding (so you catch errors early).

If you want to understand when updates hit: how often credit scores update.

How to review your report in 15 minutes (a simple process)

- Pull all three reports and save copies.

- Highlight anything that is: wrong, unfamiliar, duplicated, or outdated.

- Circle the “score movers”: late payments, collections, high utilization, many new inquiries.

- Decide: is this an error (dispute) or a real negative (strategy)?

- If it’s an error, use a clean dispute process: how to dispute credit report errors.

Common mistakes

- Checking only one bureau and assuming you’re fine.

- Disputing everything instead of targeting real errors (wastes time and can backfire).

- Ignoring identity theft signals (“that address is probably nothing”).

- Thinking paying a balance instantly updates the report (timing matters).

- Confusing “credit report” with “credit score.”

Examples / scenarios

Scenario 1: “My score dropped and I don’t know why.”

Start with the report. Look for a new late mark, collection, inquiry, or a higher reported balance.

How to check credit reports.

Credit utilization.

Scenario 2: “I’m about to apply for an apartment.”

Check all three reports first. Fix errors before you apply.

Dispute steps: how to dispute credit report errors.

Scenario 3: “I see an account I never opened.”

Treat it as potential identity theft and act fast.

Identity theft first steps.

FAQ

How do I get free credit reports?

You can access free credit reports through the standard free-report process and bureau tools. The key is getting all three bureaus and saving copies.

How often should I check my credit report?

Check before major applications and whenever something changes or looks off. If you’re rebuilding, checking every few months helps catch issues early.

Does checking my credit report hurt my credit?

No. Reviewing your own report doesn’t create a hard inquiry.

Should I check one bureau or all three?

All three when it matters. Reports can differ, and a problem can show on one bureau first.

What should I do if I find an error?

Document it and dispute the inaccurate item with a clear, targeted dispute.

How to dispute credit report errors.