Where to go next

A hard inquiry shows up when you apply for new credit and a lender pulls your report to make a decision. One inquiry usually isn’t a disaster. The real damage happens when people stack applications or apply while their utilization is already high.

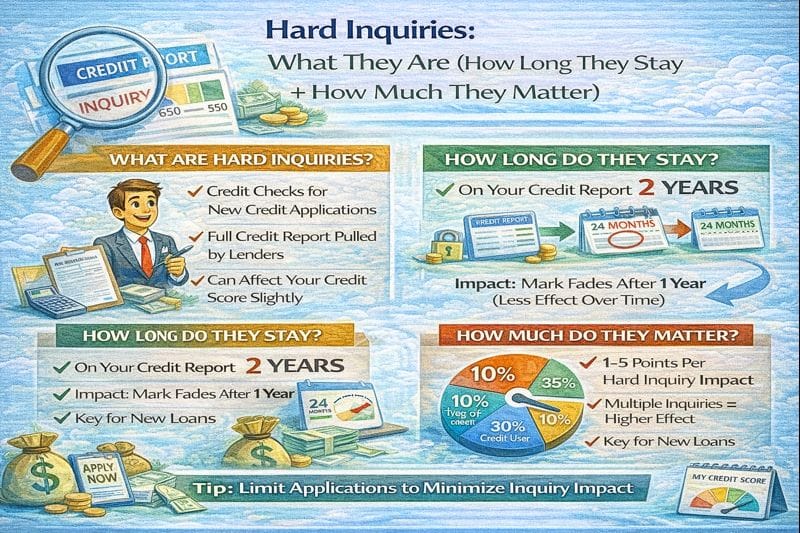

This guide explains what a hard inquiry is, how long it stays, how many points it can drop, when it makes sense to dispute, and how “rate shopping” works so you don’t get punished for shopping smart.

Quick answer / Key takeaways

- A hard inquiry typically happens when you apply for credit (card, loan).

- Hard inquiries can affect your score, but one is often a small, temporary hit.

- Hard inquiries remain on reports for a long time, but score impact usually fades sooner.

- Disputing hard inquiries only makes sense if they are unauthorized or incorrect.

- Rate shopping (auto/mortgage) can be treated differently than random card applications.

What is a hard inquiry?

A hard inquiry is a record that a lender reviewed your credit report for a new credit decision. It’s a signal you’re seeking new debt—so models treat it as a short-term risk factor.

Hard inquiries are different from “soft inquiries,” like you checking your own score.

Score check guide: how to check credit score.

How long do hard inquiries stay on a credit report?

Hard inquiries can remain on your credit report for a long time. But two timelines matter:

1) How long it’s visible on your report

Inquiries can stay listed for an extended period.

2) How long it affects your score

The score impact is usually front-loaded. The older it gets, the less it matters (assuming you don’t keep adding more).

If you’re watching monthly changes, remember utilization can move your score more than inquiries:

credit utilization.

How many points does a hard inquiry drop?

There’s no universal number because impact depends on your profile:

- thin file vs thick file,

- current score range,

- recent credit-seeking behavior,

- other negatives (lates, high utilization).

Practical expectation

- One inquiry is often a small dip.

- Several inquiries close together can be a bigger signal, especially if paired with new accounts and high utilization.

Rate shopping window (how it works)

People get burned here because they treat “shopping” like “applying everywhere.”

The idea

If you’re shopping for one loan type (like auto or mortgage), multiple inquiries made in a short period may be treated as one for scoring purposes—because models expect you to compare offers.

What still matters

- If you rate shop across many different credit types or spread it out, you can lose the benefit.

- Credit card applications are usually not treated the same way as a single-rate-shopping event.

If you’re about to apply soon, keep utilization low first. It’s the easiest lever.

Credit utilization.

Dispute hard inquiry (when it’s worth it)

Most “dispute inquiry” advice online is garbage. Here’s the only time it makes sense:

Dispute if…

- You did not authorize the application/pull.

- The inquiry is clearly incorrect (wrong business, wrong date, not tied to you).

- You have reason to believe identity theft or a mixed file issue is involved.

Identity theft steps: identity theft first steps.

General dispute process: how to dispute credit report errors.

Don’t dispute if…

- You applied and regret it.

- You clicked “submit” and now you want it removed.

- You’re hoping a dispute magically boosts your score.

If the inquiry is accurate, disputes usually come back “verified.”

Credit dispute timeline.

Table: Hard inquiry situations (what to do)

| Situation | What it means | Best move |

|---|---|---|

| One new inquiry from a real application | Normal credit-seeking | Don’t panic; stop stacking apps |

| Multiple inquiries while shopping auto/mortgage | Rate shopping | Keep it tight and focused; compare offers fast |

| Inquiry you don’t recognize | Possible fraud/mixed file | Pull reports + investigate; use ID theft flow if needed |

| Many inquiries + new accounts | High risk signal | Pause applications; focus on utilization and stability |

How to minimize inquiry damage (simple playbook)

Step 1: Stop stacking applications

If you keep applying, the “risk signal” stays fresh.

Step 2: Control utilization before you apply

High utilization + new inquiries is a bad combo.

Credit utilization.

Step 3: Use pre-qualification when available

Pre-qual is often a soft pull. It’s not a guarantee, but it can reduce wasted hard pulls.

Step 4: Rate shop correctly

If you’re shopping a loan:

- do it in a tight window,

- compare real offers,

- don’t mix in random card apps at the same time.

Step 5: Check your reports for accuracy

Sometimes inquiries appear on one bureau and not others.

How to check credit reports.

Common mistakes

- Applying for multiple cards to “build credit faster.”

- Shopping loans slowly over months instead of in a tight window.

- Disputing accurate inquiries (wastes time).

- Ignoring high utilization while chasing approvals.

Examples / scenarios

Scenario 1: “I had one inquiry and my score dropped.”

That can happen. The effect is usually temporary. Keep utilization low and don’t add more inquiries.

Credit utilization.

Scenario 2: “I’m shopping for an auto loan.”

Do your comparisons in a tight window and don’t stack credit card applications at the same time.

Scenario 3: “There’s an inquiry I don’t recognize.”

Treat it as a fraud check. Pull all three reports and take identity theft steps if needed.

How to check credit reports.

Identity theft first steps.

FAQ

How long do hard inquiries stay?

They can remain listed for a long time, but the score impact usually fades as they age.

How many points does a hard inquiry drop?

It depends on your profile. One is often a small dip; many inquiries can add up.

Can I dispute a hard inquiry?

Only if it’s unauthorized or incorrect. Disputing accurate inquiries usually fails.

What is the rate shopping window?

A period where multiple inquiries for one loan type may be treated as one for scoring purposes, encouraging you to compare offers.

Do hard inquiries hurt more than utilization?

Often no. Utilization can swing scores more quickly month to month.

Credit utilization.