Where to go next

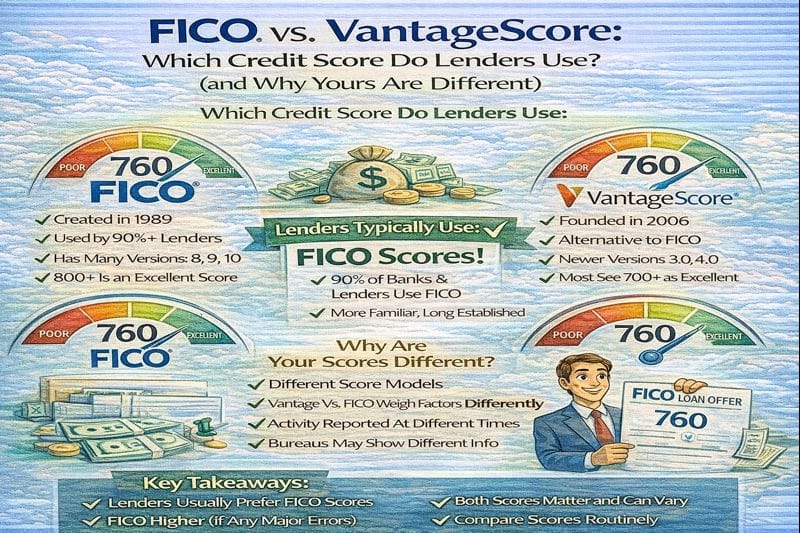

FICO and VantageScore are two different credit scoring brands. They both use your credit report data, but they weigh factors differently and can react differently to the same change (like a new card, a paid-down balance, or a medical collection).

This guide explains the real-world differences, which score lenders tend to use, and why your score from one app can be 40–80 points away from another.

Quick answer / Key takeaways

- FICO and VantageScore can show different numbers because the models weigh your report data differently.

- Many lenders commonly use FICO for lending decisions, but it varies by lender and product.

- Your scores differ because of model differences, bureau differences, and timing (statement balances and reporting cycles).

- “Credit Karma score” is typically VantageScore, not FICO.

- The fastest way to influence most scores short-term is often credit utilization and statement timing: credit utilization.

FICO vs VantageScore (what’s the difference in one line)

- FICO: a family of scoring models used widely in lending, with multiple versions by product.

- VantageScore: a different scoring model family created by the credit bureaus, commonly shown by many consumer apps.

Both are “real” scores. The question is: which one matters for your next application?

Which score do lenders use?

Most lenders use whatever their underwriting system is built around, which can be:

- a FICO version (common),

- a VantageScore version (less common for lending decisions), or

- sometimes internal scores layered on top of bureau data.

Practical rule

If you’re preparing for a major application (mortgage, auto, big credit line), you want to know:

- which bureau(s) the lender pulls, and

- which model/version they rely on.

You can’t control their choice—but you can track the right score once you know it.

Why my scores are different (most common causes)

1) Different scoring model (FICO vs VantageScore)

Same report → different math.

Example: one model might be more sensitive to utilization changes, or treat thin credit files differently.

2) Different credit bureau data

You don’t have one credit report—you have three (Experian, Equifax, TransUnion). One bureau may have:

- a different balance,

- an extra account,

- a missing account,

- or an outdated status.

Check all three reports first: how to check credit reports.

3) Timing (statement balance vs payment date)

A card can report a high statement balance even if you pay in full later. That can move one score more than another depending on the model.

Reporting cycle guide: how often credit scores update.

4) Recent changes: new accounts or inquiries

New accounts and hard inquiries can cause short-term drops. Some models react differently.

Hard inquiries explained: hard inquiries.

5) Errors

Wrong late payments, duplicate collections, accounts that aren’t yours—these can create score gaps and “mystery drops.”

Dispute steps: how to dispute credit report errors.

FICO score vs Credit Karma score

If you’re comparing “my FICO score vs Credit Karma score,” you’re usually comparing:

- FICO (often used by lenders), vs

- VantageScore (often shown in consumer apps).

That’s why people see big gaps and think something is “wrong.” Usually it’s just different models, sometimes also different bureau data.

If your goal is approvals and APR, use the score that matches your target lender as closely as you can.

Table: FICO vs VantageScore (side-by-side)

| Category | FICO | VantageScore |

|---|---|---|

| What it is | A family of scoring models used in many lending systems | A different scoring model family, often shown by consumer apps |

| Range | Typically 300–850 (depends on version) | Typically 300–850 (depends on version) |

| What it uses | Your credit report data | Your credit report data |

| Why scores differ | Different factor weighting and model rules | Different factor weighting and model rules |

| Most useful for | Often tracking what many lenders may use | Useful for trend tracking and monitoring |

| Best move | Track it if your lender uses it; focus on report fundamentals | Track trends; focus on report fundamentals |

What to do when your scores don’t match (step-by-step)

Step 1: Stop comparing scores without labels

Write down:

- the model (FICO or VantageScore),

- the bureau (Experian/Equifax/TransUnion),

- the date the score was pulled.

If you can’t see model + bureau, the number is less useful.

Step 2: Check your credit reports, not just scores

Your score is the output. Your report is the input.

How to check credit reports.

Step 3: Fix the fastest lever first (utilization)

If you’re trying to “clean up” a score gap quickly, start here:

credit utilization.

Then learn timing: how often credit scores update.

Step 4: Handle inquiries and new accounts strategically

Avoid stacking applications when you’re about to apply for something important.

Hard inquiries.

Step 5: Dispute real errors (targeted)

If an item is inaccurate, fix it at the source.

How to dispute credit report errors.

How to pick the right score to track (without guessing)

If you’re applying soon (next 30–90 days)

Track:

- the bureau reports, and

- the score model most likely used for your product.

Also focus on short-term improvements:

- lower utilization,

- avoid new hard inquiries,

- prevent any late payments.

If you’re rebuilding long-term

You can track either model, but measure progress by fundamentals:

- no new late payments,

- utilization kept low,

- fewer new accounts,

- errors removed.

Start with basics if you need the full “what moves scores” breakdown:

what is a credit score.

Examples / scenarios

Scenario 1: “My score is 760 in one place and 710 in another.”

Most likely: different model and/or different bureau. Confirm both labels and compare your three reports.

How to check credit reports.

Scenario 2: “My score dropped after I paid my card.”

Often statement timing. You paid after the statement closed, so a high balance reported. Fix the timing next cycle.

Credit utilization.

How often credit scores update.

Scenario 3: “I’m about to apply for a car loan. Which score matters?”

The score your lender uses. Keep utilization low, avoid new inquiries, and make sure your reports are clean.

Credit utilization.

Hard inquiries.

FAQ

Which credit score do lenders use?

It varies by lender and product. Many lenders commonly use FICO models, but some use other scores or internal systems. The key is knowing the model and bureau your lender pulls.

Why are my FICO and VantageScore different?

They use different scoring rules and may be based on different bureau data or different reporting timing.

Is VantageScore “fake”?

No. It’s a real score model. It’s just not the one every lender uses for decisions.

Why is my Credit Karma score different from my bank’s score?

Often because Credit Karma typically shows a VantageScore, while many banks and lenders show a FICO score.

What’s the fastest way to raise either score?

For many people: lower utilization and control statement timing.

Credit utilization.

Should I check my credit reports or just track the score?

Check the reports. Fixing report issues is how scores improve.

How to check credit reports.