Where to go next

Credit utilization is one of the fastest-moving parts of a credit score because it changes month to month. You can pay on time every month and still get punished if your reported balances are high when your card reports.

This guide explains utilization in plain English, what an “ideal” ratio usually means in practice, how to lower utilization fast, and the timing trick most people miss: paying before the statement date.

Quick answer / Key takeaways

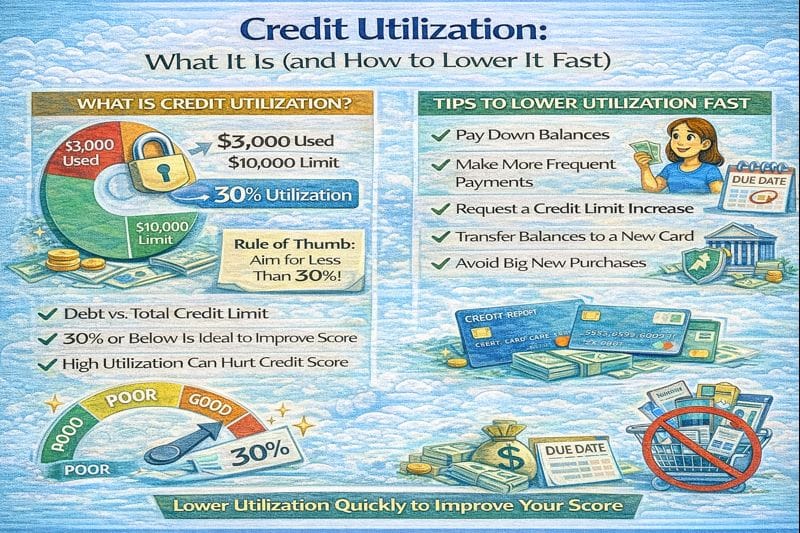

- Credit utilization = reported card balances ÷ credit limits (per card and overall).

- Utilization is usually most powerful for revolving debt (credit cards).

- Many people see better scores when utilization stays low (think “keep it comfortably under 30%,” and even lower for best results).

- Paying in full isn’t the same as reporting low—statement timing decides what gets reported.

- The fastest fix is often paying before the statement closing date: how often credit scores update.

What is credit utilization?

Credit utilization is the percentage of your available revolving credit you’re using. It’s calculated using the balance that gets reported to the bureaus, which is often your statement balance, not your current balance right after payment.

Utilization is measured two ways

- Per-card utilization: each card’s balance vs that card’s limit

- Overall utilization: total balances across cards vs total limits

Both can matter. You can have “low overall” but one maxed card and still get dragged.

Ideal utilization ratio (what “good” actually means)

There isn’t one magic number because scoring models aren’t published in full, but here’s the practical tiering people use:

- 0–9%: often strongest for scoring (if you still show activity)

- 10–29%: usually okay to good

- 30%+: commonly where scores start taking noticeable hits

- 50%+: often heavy score pressure

- 90–100%: high risk signal (even with on-time payments)

If you’re rebuilding, your job is simple: keep it low and stable.

Utilization vs score (why it moves the number fast)

Utilization is “sensitive” because it updates with reported balances. That’s why:

- you can improve it quickly, and

- you can accidentally hurt it in one heavy month.

If your score changes every month and you “did nothing,” it’s often utilization + reporting timing:

how often credit scores update.

Pay before statement date (the timing trick)

Most cards report around the statement closing date. If your statement cuts with a high balance, that high balance can be what gets reported—even if you pay it off days later.

The two-date method (simple)

- Statement closing date: determines what balance becomes the statement balance

- Due date: when you must pay to avoid late fees/late reporting

Goal: pay enough before the statement closes so the statement balance is low.

How to lower utilization fast (step-by-step)

This is your “how to lower utilization fast” tail. Here’s the clean playbook.

Step 1: Identify your highest-utilization card

Not the biggest balance—often the highest percentage of limit.

Step 2: Pay that card down before statement close

Even a partial paydown can change the reported utilization.

Step 3: Spread spending across cards (if you must use cards)

Instead of putting everything on one card, distribute to keep per-card utilization low.

Step 4: Ask for a credit limit increase (only if it won’t cause damage)

A higher limit can lower utilization, but:

- some issuers do a hard pull,

- higher limits don’t help if spending rises too.

If you’re about to apply for a loan, don’t gamble with new inquiries:

hard inquiries.

Step 5: Keep accounts current—no new late payments

Utilization fixes help, but late payments are heavier.

Late-payment strategy: remove late payments.

Table: Utilization fixes (fast vs slow)

| Move | Speed | Best for | Watch-outs |

|---|---|---|---|

| Pay before statement close | Fast | Quick score lift | You need the closing date |

| Pay mid-cycle (multiple payments) | Fast | Irregular income | Requires discipline |

| Spread balances across cards | Medium | Avoid one maxed card | Still totals matter |

| Credit limit increase | Medium | Stable spenders | Hard pull risk |

| Add a new card | Slow | Building long-term | Hard inquiry + new account |

Common mistakes that keep utilization high

- Paying only on the due date (statement already reported high).

- Maxing one card while others are unused.

- Closing a card (reduces total available credit and can spike utilization).

- Using “0% interest” promos as an excuse to carry high balances.

- Trying to “build credit” by carrying a balance (you don’t need to pay interest).

Examples / scenarios

Scenario 1: “I pay in full, but my utilization shows 40%.”

You’re likely paying after the statement closes. Pay before statement close next cycle so the reported balance is lower.

how often credit scores update.

Scenario 2: “One card is near max, but overall utilization is okay.”

Per-card utilization can still drag you. Pay down the maxed card first.

Scenario 3: “I need a score bump in 30 days.”

Utilization is your best shot. Pay down balances before statement close and avoid new hard inquiries.

Hard inquiries.

FAQ

What is credit utilization?

It’s the percentage of your available revolving credit you’re using, based on reported balances vs limits.

What is the ideal utilization ratio?

Many people aim under 30% for decent scores and often under 10% for best results, but exact scoring behavior varies.

How do I lower utilization fast?

Pay down balances before the statement closing date, especially on the highest-utilization card.

How often credit scores update.

Does paying in full always fix utilization?

Not if you pay after statement close. Timing controls what gets reported.

Should I close a credit card to help utilization?

Usually no—closing a card can reduce your total limit and increase utilization.