Where to go next

Credit score ranges are the “translation layer” between a number and what lenders think it means. A 720 usually signals low risk. A 620 usually signals “price it higher or say no.” But your result depends on which scoring model is being used and what’s on your credit reports.

This guide explains common credit score ranges, what “good vs excellent” typically means, and how to move up a tier without guessing.

Quick answer / Key takeaways

- Most scores run from 300 to 850 (higher is generally better).

- For many lenders, 670+ is commonly viewed as “good,” 740+ as “very good,” and 800+ as “excellent/exceptional” (varies by model and lender).

- Your scores can differ because FICO and VantageScore use different formulas and data handling: fico vs vantagescore.

- The fastest short-term lever for many people is credit utilization (reported balances vs limits): credit utilization.

- Checking your own score is usually a soft inquiry and doesn’t hurt: how to check credit score.

Credit score ranges (the simple meaning)

A “range” is just a category that helps lenders quickly label risk (poor/fair/good/excellent). You don’t need perfection—you need the score tier that fits your next goal (approval, decent APR, higher limits, lower deposits).

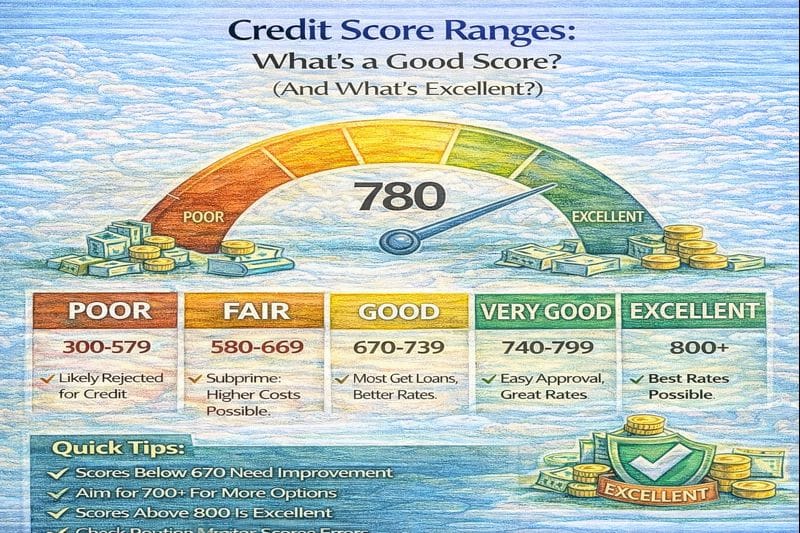

Credit score chart: common ranges (FICO vs VantageScore)

Different models use the same 300–850 scale, but the category cutoffs can differ.

| Category | FICO (commonly used ranges) | VantageScore 3.0 (commonly used ranges) |

|---|---|---|

| Poor / Very poor | 300–579 | 300–499 |

| Fair | 580–669 | 500–600 |

| Good | 670–739 | 601–660 (often labeled “Fair”) / 661–780 (Good) |

| Very good | 740–799 | 661–780 |

| Excellent / Exceptional | 800–850 | 781–850 |

If you want the “why are my scores different?” breakdown:

fico vs vantagescore.

What is a good credit score?

In practical terms, “good” usually means:

- you’re less likely to be automatically rejected,

- you have more pricing power (better APR offers),

- you have more product options.

Many people treat 670+ as a rough “good” milestone, but lenders can be stricter or looser depending on the product and your full profile (income, debt-to-income, down payment, collateral, recent negatives).

What is an excellent credit score?

“Excellent” usually means you’re in the top risk tier:

- approvals are easier (all else equal),

- pricing is typically best-available,

- limits and terms are generally more favorable.

Many people use 800+ as the “excellent” mental marker, but don’t chase it blindly—what matters is what’s holding you back from the next tier.

Why your score might be “good” in one place and “fair” in another

This is the most common confusion on credit.

1) Different scoring models

FICO vs VantageScore can grade the same report differently.

Fico vs vantagescore.

2) Different bureau data

One bureau may have an account or balance that another doesn’t. Check all three reports:

how to check credit reports.

3) Timing (statement balance vs payment date)

You can pay in full and still show a high reported balance if you paid after the statement closed. Reporting cycle guide:

how often credit scores update.

What range do you actually need? (goal-based way to think)

Use ranges as a tool, not a trophy.

- Just want approvals and decent terms: focus on getting into “good” and staying clean.

- Chasing best pricing: push toward “very good/excellent” by optimizing utilization and keeping the file stable.

- Recovering from negatives: the fastest wins are usually preventing new late payments + lowering utilization; then handle errors.

Start with the basics if you’re unsure what’s moving your score:

what is a credit score.

How to find your real range (and stop guessing)

Step 1: Check your score (the right way)

Use a source that shows the model and bureau when possible.

How to check credit score.

Step 2: Confirm what lenders will likely use

Many lenders use FICO versions for lending decisions, but not always. The safest move is to know both:

fico vs vantagescore.

Step 3: Check your credit reports (not just the number)

The score is the symptom. The report is the cause.

How to check credit reports.

Step 4: Identify what’s blocking the next tier

In most cases it’s one of these:

- utilization too high (even if you pay on time),

- recent late payments,

- too many new accounts/inquiries,

- errors/old collections.

Utilization playbook (fast wins): credit utilization.

Hard inquiries basics: hard inquiries.

How to move up a credit score range (fastest realistic order)

1) Fix utilization first (most common fast mover)

Lower what gets reported—especially before statement closing.

Credit utilization.

How often credit scores update.

2) Prevent new late payments (the “never again” rule)

Autopay at least the minimum. Late marks are expensive and slow to fade.

3) Stop stacking new applications

If you’re trying to climb ranges, avoid unnecessary hard pulls and new accounts.

Hard inquiries.

4) Dispute real errors (targeted, not random)

If your report is wrong, fix the source.

How to dispute credit report errors.

Examples / scenarios (If X → do Y)

Scenario 1: “I’m at 690. How do I get to 720+?”

Start with utilization and timing. Many people can move a tier by lowering reported balances and paying before statement close.

Credit utilization.

How often credit scores update.

Scenario 2: “One site shows 740, another shows 705.”

That’s usually model/bureau differences. Check which score you’re seeing and compare your reports across bureaus.

Fico vs vantagescore.

How to check credit reports.

Scenario 3: “My score dipped even though I paid on time.”

Often it’s a higher reported statement balance or a new inquiry/new account posting.

How often credit scores update.

Hard inquiries.

FAQ

What is a good credit score?

Often, “good” starts around the high 600s in many common scoring categories, but exact cutoffs vary by model and lender.

What is an excellent credit score?

Many people treat 800+ as excellent/exceptional, but lenders still look at your full profile (income, debt-to-income, recent negatives).

Why do I have different credit scores?

Different models (FICO vs VantageScore), different bureau data, and timing differences can all change the number.

Fico vs vantagescore.

What’s the fastest way to move up a range?

For many people: lower utilization and control statement timing.

Credit utilization.

Should I focus on the score or the report?

The report. Scores follow what’s on the report.

How to check credit reports.

Does checking my credit score hurt it?

Usually no if it’s a soft inquiry (most consumer score checks are).

How to check credit score.