Where to go next

When you file a credit report dispute, the hard part isn’t clicking submit—it’s the waiting, the vague updates, and the “verified” result that feels like a dead end.

This guide explains how long credit disputes typically take, what statuses mean, what to do if your dispute is denied, and how reinvestigation works when you have stronger evidence.

Quick answer / Key takeaways

- Many disputes resolve in weeks, but timelines vary depending on bureau, complexity, and evidence.

- “Verified” usually means the data furnisher confirmed the info as accurate—not that the bureau “proved” it correct.

- If your dispute is denied/verified, your next move is better documentation + a narrower dispute, not repeating the same claim.

- Identity theft disputes follow a different urgency path: identity theft first steps.

- If you haven’t pulled all three reports, do that first: how to check credit reports.

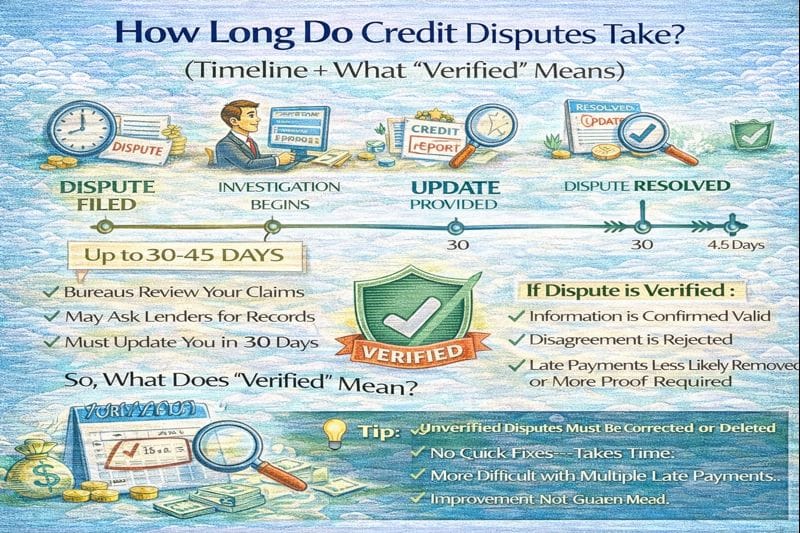

Credit dispute timeline (what happens after you submit)

Think of a dispute like a process pipeline:

- Bureau receives the dispute

- Bureau forwards it to the data furnisher (creditor/collector)

- Furnisher confirms, corrects, or can’t validate

- Bureau updates your report and notifies you

Your outcome depends on two things:

- how clearly you identified the error, and

- how strong your evidence is.

If you need the clean filing steps first: how to dispute credit report errors.

How long do credit disputes take? (realistic stages)

Stage 1: Submission and confirmation (Day 0–3)

What you’ll see:

- confirmation email/number (online), or delivery confirmation (mail).

What to do:

- save the confirmation, screenshots, or mailing proof.

Stage 2: Investigation period (Week 1–4)

This is the core waiting window. The bureau contacts the furnisher and processes the response.

What to do:

- don’t file duplicates while it’s active (it can slow things down),

- prepare any extra proof in case it comes back “verified.”

Stage 3: Result posted + report updates (Week 2–6)

You’ll get a result like:

- deleted,

- corrected/updated,

- verified/no change,

- partially corrected.

What to do:

- compare before/after reports and save copies.

Table: Dispute results and what they mean

| Result | What it usually means | Your next move |

|---|---|---|

| Deleted | Item removed from the report | Save copies; monitor all 3 bureaus |

| Corrected/Updated | Item changed (status/balance/dates) | Confirm it’s now accurate; keep proof |

| Verified | Furnisher confirmed it as accurate | Escalate with stronger evidence or narrower claim |

| No change | Bureau didn’t change the item | Review if your dispute lacked proof; re-file only with new info |

| Partial change | Some fields changed, others didn’t | Dispute the remaining inaccurate part with specific proof |

Dispute results “verified” (what it really means)

When people see “verified,” they assume the bureau investigated deeply. In reality, “verified” typically means:

- the furnisher responded that the item is accurate as reported.

So the question becomes: did your dispute include proof strong enough to force a correction?

Common reasons an error gets “verified”

- You disputed a real negative (accurate late payment) instead of an error.

- Your dispute was too broad (“not mine”) without documentation.

- The furnisher’s records disagree with your memory, and you didn’t attach proof.

- You disputed online and couldn’t attach enough evidence.

If you’re trying to remove accurate late payments, that’s a different strategy page:

remove late payments.

What if your dispute is denied? (the smart next steps)

Denied/verified doesn’t automatically mean you’re wrong. It often means your case wasn’t proven.

Step 1: Narrow the claim

Instead of: “This whole account is wrong.”

Do: “The May 2025 payment status is incorrect; it should be current.”

Step 2: Upgrade your evidence

Bring:

- statements showing status,

- payoff letters,

- settlement letters,

- payment confirmations,

- identity theft documentation (if relevant).

Step 3: Re-file only if you have new/stronger support

Repeating the same dispute with the same weak evidence usually gives the same result.

Step 4: Consider switching method (online → mail)

Mail disputes are often better when you need to attach multiple documents and control the narrative.

How to dispute credit report errors.

Reinvestigation credit dispute (what it is and when to use it)

A reinvestigation is basically: “I’m disputing again because I have new evidence or the prior review didn’t resolve the inaccuracy.”

Use reinvestigation when:

- you have better documentation than the first time,

- the bureau corrected part but not all,

- your dispute was misunderstood or mis-coded.

Don’t use reinvestigation when:

- you’re trying to delete accurate negatives with no proof,

- you’re just hoping a different rep will do it.

How to track disputes across all three bureaus

Disputes can resolve differently across bureaus because the data differs.

Checklist:

- dispute only where the error appears,

- track confirmation numbers per bureau,

- keep before/after copies of each bureau’s report.

Start with pulling all three: how to check credit reports.

Common mistakes that slow disputes or kill results

- Filing the same dispute multiple times while one is open.

- Disputing too many items at once with vague claims.

- Not attaching proof (or attaching irrelevant proof).

- Disputing identity theft as a normal “error” dispute.

- Not checking whether the item is actually accurate.

Identity theft flow: identity theft first steps.

Examples / scenarios (If X → do Y)

Scenario 1: Your dispute came back “verified” but you have proof

Re-file with a narrow claim and attach the exact statement/letter that proves the error. Consider mailing it.

Scenario 2: Your dispute was denied and you have no documentation

Pull your reports, request records from the creditor/collector, and only dispute once you can prove the inaccuracy.

Scenario 3: You see accounts you don’t recognize

Treat it as potential identity theft and use the dedicated steps.

Identity theft first steps.

FAQ

How long do credit disputes take?

Many disputes resolve in weeks, but timelines vary by bureau and complexity. Expect a multi-week cycle from submission to final update.

What does “verified” mean on a credit dispute?

It usually means the furnisher confirmed the information as accurate as reported. It’s not a detailed “court-like” proof process.

What if my dispute is denied?

Narrow the claim, strengthen documentation, and re-file only when you have better evidence. Switching to a mailed dispute can help for complex cases.

Can I ask for reinvestigation?

Yes—reinvestigation makes sense when you have new evidence or the prior review didn’t fix an inaccuracy.

Should I dispute online or by mail?

Online works for simple issues. Mail is often better for complex disputes with multiple documents.

How to dispute credit report errors.