Where to go next

A collections account on your credit report is a signal that a bill went unpaid long enough to be sent or sold to a collector. Collections can hurt approvals, rates, and sometimes even housing decisions—but not all collections are equal, and the right move depends on whether the item is accurate, how old it is, and whether it’s medical.

This guide explains how to remove collections when that’s realistic, when paying helps (and when it doesn’t), what “pay for delete” really means, and a clean step-by-step plan.

Quick answer / Key takeaways

- First move: confirm the collection is accurate and actually belongs to you. If it’s wrong, dispute it.

- “Pay for delete” is sometimes possible with collectors, but it’s not guaranteed and should be in writing.

- Paying a collection can help in some situations, but outcomes depend on what reporting changes after payment.

- Medical collections can follow different rules and may be treated differently than non-medical collections.

- If identity theft is involved, use the dedicated flow: identity theft first steps.

What “collections on credit report” means

A collection entry usually appears after:

- a creditor charges off or sends an account to a collection agency, or

- a debt buyer purchases the debt and reports it.

Collections can show differently across bureaus. That’s why you check all three reports:

how to check credit reports.

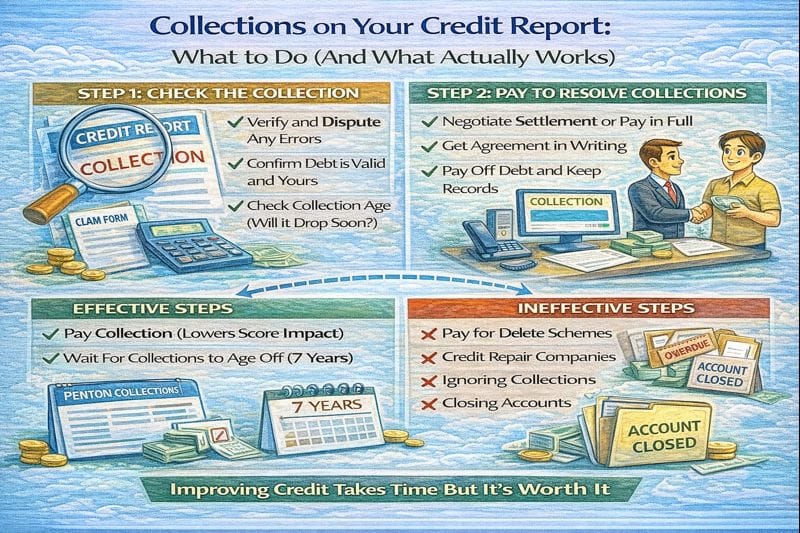

Step 1: Verify the collection (don’t pay blind)

Before you do anything, answer these:

- Is this debt actually mine?

- Is the amount correct?

- Is the date information consistent (first delinquency, opened date)?

- Is it reporting on one bureau or all three?

If the account is unfamiliar: identity theft first steps.

Step 2: Decide which “lane” you’re in (the only 3 that matter)

Lane A: The collection is inaccurate (best case)

Dispute it with proof.

How to dispute credit report error.

Lane B: The collection is accurate, but you can negotiate terms

This is where “pay for delete” or settlement terms may matter.

Lane C: The collection is accurate and negotiation won’t change reporting

Then your plan is:

- pay/resolve if it helps your goals,

- rebuild around it (utilization, on-time payments, clean new history).

Fast wins while rebuilding: credit utilization.

How to remove collections from credit report (realistic options)

Option 1: Dispute inaccurate collections (most reliable removal path)

Dispute if:

- not yours,

- wrong amount/status,

- duplicate reporting,

- wrong dates,

- already paid but still reporting incorrectly.

Process: how to dispute credit report errors.

Timeline results explained: credit dispute timeline.

Option 2: Negotiate “pay for delete” (possible, not guaranteed)

“Pay for delete collections” means you pay (or settle) and the collector agrees to delete the collection tradeline from your credit reports.

Important rules:

- Get it in writing before you pay.

- If they won’t put it in writing, assume it won’t happen.

- Don’t confuse “paid” with “deleted.”

Option 3: Pay/settle without deletion (still can be the right move)

Even if deletion isn’t on the table, paying can still matter if:

- you’re trying to qualify for something that requires no unpaid collections,

- the collector is escalating,

- you want the debt resolved for peace of mind.

But paying doesn’t guarantee a big score jump. Your file context matters.

Does paying collections help your credit?

Sometimes—but not always the way people expect.

When paying can help

- Your overall profile improves (less unpaid debt risk).

- Some lenders view paid collections more favorably than unpaid.

- You remove a blocker for underwriting rules that require collections resolved.

When paying may not move the score much

- If the scoring model doesn’t reward the change strongly,

- if there are other major negatives (late payments, high utilization),

- if the collection remains on the report as “paid” but still counts as a negative item.

Either way, you still want to clean up the “fast movers” too:

credit utilization

remove late payments

Medical collections on credit report (what’s different)

Medical collections are a special category. In the real world:

- medical collections often come from billing confusion and insurance timing,

- reporting/handling can be different than non-medical collections,

- you should verify accuracy carefully before paying.

If you think a medical collection is wrong, dispute it with supporting documentation (EOBs, bills, insurer letters).

How to dispute credit report errors.

Table: Collections strategy (what to do based on the situation)

| Situation | Best move | What to get in writing | Goal |

|---|---|---|---|

| Not yours / inaccurate | Dispute with proof | Dispute confirmation + documents | Deletion/correction |

| Collector offers pay for delete | Negotiate + confirm | Delete agreement before payment | Removal |

| Accurate, no deletion offered | Settle/pay to resolve | Settlement terms + “paid/settled” letter | Resolution |

| Medical collection with confusion | Verify + dispute if wrong | Bills/EOBs + dispute packet | Correction/deletion |

Step-by-step: what to do this week

- Pull all three credit reports and screenshot/save the collection details.

How to check credit reports. - Verify it’s yours and the amount/dates make sense.

- If inaccurate: dispute with proof.

How to dispute credit report errors. - If accurate: decide whether you want to negotiate deletion or just resolve it.

- Ask for pay-for-delete terms in writing (if available).

- If not available, decide whether paying still helps your real goal (approval, rental, peace of mind).

- While this is in motion, keep utilization controlled and payments perfect.

Credit utilization.

Common mistakes (collections edition)

- Paying immediately without verifying accuracy.

- Disputing accurate collections with no proof (wastes time).

- Believing “paid = deleted.”

- Not getting terms in writing.

- Ignoring identity theft signals.

Identity theft first steps.

Examples / scenarios

Scenario 1: “I don’t recognize this collection.”

Treat it as possible identity theft or mixed file. Pull reports and use the fraud-first steps.

Identity theft first steps.

Scenario 2: “The collection is mine, and I want it gone.”

Try pay for delete—get it in writing before you pay. If they refuse, decide whether paying still helps your goal.

Scenario 3: “It’s medical and the amount seems wrong.”

Collect your bills/EOBs and dispute the specific inaccuracy.

How to dispute credit report errors.

FAQ

How do I remove collections from my credit report?

If the collection is inaccurate, dispute it with proof. If it’s accurate, deletion may be possible through a pay-for-delete agreement (not guaranteed). Otherwise the collection may remain but can be marked paid/settled.

Does paying collections help?

It can, especially for underwriting rules and overall risk profile, but it doesn’t guarantee a big score jump. Your overall report factors still matter.

What is pay for delete?

An agreement where the collector deletes the tradeline after you pay or settle. Get it in writing before payment.

Are medical collections different?

Often, yes. Verify accuracy carefully and dispute inaccuracies with documentation when needed.

Should I dispute a collection that is accurate?

Disputing accurate items without proof usually results in “verified.” Dispute only inaccuracies.

Credit dispute timeline.